Sensex recently hit 50,000. The index of the thirty biggest Indian companies by market capitalization listed in Bombay Stock Exchange has appreciated 50X in the last 30 years: From 1,000 on 27 July 1990 to 50,000 on 21 January 2021.

The only other asset class that comes to mind with similar – or even higher – multiple than 50X is Bombay Real Estate.

So I asked myself, which was the better investment between Bombay Stock Exchange and Bombay Real Estate in the last 30 years? This blog post is the result.

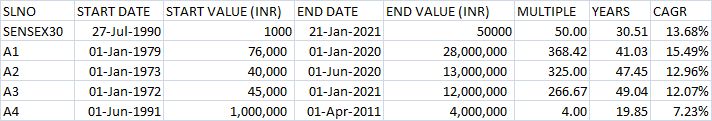

Given below is a comparison of returns from Sensex with those from a few Bombay Real Estate transactions I’ve heard about in the last 30 years or more:

*: Cf. online calculator at CAGR Formula & Table.

As you can see from the above table, the annualized returns of Sensex during the 30 year period is 13.68%.

Bombay Real Estate A1 has beaten it. A2 and A3 have come close to it. A4 has trailed it by a mile. (JFYI, the 10 year CAGR of Bitcoin is 167%, click here for more.)

To me, the most striking difference between Bombay Real Estate and Bombay Stock Exchange is that, you could get similar returns by investing in any random property in Bombay whereas you couldn’t realize the 13.68% annualized return by investing in Sensex.

To me, the most striking difference between Bombay Real Estate and Bombay Stock Exchange is that, you could get similar returns by investing in any random property in Bombay whereas you couldn’t realize the 13.68% annualized return by investing in Sensex.

That’s because you couldn’t invest in Sensex in the first place.

While the layperson thinks that Sensex is representative of the overall equity asset class, it’s not. Nor is it some scrip that you can go out and buy.

Sensex is an index comprising a basket of 30 scrips where the scrips keep changing all the time. As testimony, only five out of the 30 stocks in Sensex in 1990 are there in it today.

(As an aside, in case anyone still has any doubts, Sensex is most certainly not representative of the overall economy.)

As I highlighted in Equity Always Underperforms Fixed Deposits, stock picking and timing decide equity alpha. Without the right combination of these two factors, your stock portfolio may well have trailed Fixed Deposits, let alone Bombay Real Estate.

Ergo Bombay Real Estate is a more homogeneous asset class compared to Bombay Stock Exchange.

Not surprisingly, many of us have heard about people who have actually gained the aforementioned kind of appreciation in Bombay Real Estate but I strongly doubt if any of us has heard of anyone who plonked in INR 1,000 in Sensex in 1990 and took out INR 50,000 last week (I haven’t).

Stock market punters might point to ETFs to counter my contention that Bombay Stock Exchange is not as homogeneous as Bombay Real Estate. For the uninitiated, ETF is a low-cost, passive Exchange Traded Fund that tracks the index. If a stock enters the Sensex, the ETF buys it. If a stock leaves the Sensex, the ETF sells it. Period.

While they’re not wrong, I’d like to temper their counterview with my experience of investing in ETFs:

- It’s not easy to find a pure ETF because most ETFs in India are Equity Traded Funds that are weighted towards specific sectors.

- ETF offers very little – or no? – commission, so it’s difficult to find a brokerage house that is interested in your ETF business. I reached out to three different brokerages when I wanted to invest in ETFs. Not one reverted back. When I followed up with them, all three of them tried to talk me out of ETFs.

- I then found out that I could buy and sell ETFs on online brokerages like ICICIdirect.com. I went ahead and bought a bunch of ETFs. When it came time to sell them, I discovered that my SELL order went unexecuted for two days in a row. It was only then that I learned that ETFs have low liquidity.

- By chance, while I was researching this post last week, I learned that some fund houses have launched ETF funds. While they have a higher expense ratio than pure ETFs, they provide greater liquidity. Shout out to my friend and fellow IIT Bombay alumni, Santosh Madbhavi, for tipping me off about ETF funds and for contributing to this blog post in other ways.

Some others might say that very few people can afford to buy an apartment in Mumbai but that many people can afford to buy an ETF (which tracks Sensex) – or even a share of Bajaj Finance or HDFC or Page Industries (which have all beaten Sensex by a country mile). While that’s true,

- Fact is, retail equity penetration in India is still less than 5%.

- REIT enables fractional real estate ownership, so, many people can afford to buy a share in a Mumbai apartment – or office – now.

Still some others might assert that Bombay Stock Exchange is more liquid than Bombay Real Estate. I agree, but only if you buy stocks in the current DEMAT regime under which you’d receive your shares natively in DEMAT form. That was not the case 30 years ago, when shares existed only in the form of paper certificates.

Many people who bought paper shares 30-40-50 years ago have not been able to convert them to DEMAT form. Those shares are effectively illiquid under the present “Compulsory DEMAT” regime in which stocks can be traded only in DEMAT form. Also see my above remark about poor liquidity of ETF.

The average Bombay Real Estate investor has made gains that approach or exceed the annualized Sensex returns of 13.68%.

But the average Bombay Stock Exchange investor has not made the annualized Sensex returns of 13.68%. Some stock-pickers have made Sensex-beating returns but other stock-pickers have not, so stock-pickers don’t qualify as the average Bombay Stock Exchange investor.

The 13.68% CAGR is real when it comes to Bombay Real Estate. But it’s a mirage when it comes to Bombay Stock Exchange.

The average Bombay Real Estate investor got better returns than the average Bombay Stock Exchange / Sensex investor in the past 30 years.

I make no comments about the future since I’m not an accredited financial advisor and because “past performance is not a guarantee of future results” as they say in the financial services industry.

While on the topic, here are a few comments and observations:

“Bombay Real Estate” contrasts well with “Bombay Stock Exchange”. Besides, through a majority of the period in question, India’s commercial capital has gone by Bombay, with the rechristening to Mumbai having happened relatively recently. That’s why I’ve used Bombay Real Estate as the moniker for the island city’s real estate asset class.

For those of you who are wondering why it’s not Mumbai Stock Exchange, organizations like Bombay Stock Exchange – and IIT Bombay and Bombay High Court, to name a few others – have “Bombay” in their incorporation certificates, so they can’t introduce Mumbai in their names that easily. That said, they do say Mumbai when they refer to their location e.g. Bombay Stock Exchange, Phiroze Jeejeebhoy Towers, Fort, Mumbai 400001; IIT Bombay, Powai, Mumbai 400076.

Back in the day, as a Marketing Executive at a leading IT company, I used to sell truckloads of computers and software to Bombay Stock Exchange. I’d regularly visit BSE’s office housed in Phiroze Jeejeebhoy Towers in the Fort neighborhood of then-Bombay those days. There was a two week period when I’d actually camped in the so-called “S Floor” of PJ Towers, which is where BSE’s Computer Systems Department was located. One day, during that period, I actually met the inventor of SENSEX! Thanks to this unique good fortune, I have more than a casual attachment to Sensex. That’s saying something because, in those days, the average Bombayite’s mood in the evening would depend on where Sensex closed that day! That also explains why this post is silent about the other leading index of India’s equity market!