Courier services stopped operating during the pandemic-caused lockdown. I have not received the FORTUNE GLOBAL 500 issue. This is the first time I don’t have this issue in my hands since I started tracking this list almost 25 years ago.

This post is written based on my review of the magazine’s website. Please excuse its sketchiness: The website’s UX sucks; besides, it lacks a lot of information that’s carried by the print package.

You can sell 10% of your company's equity for $100M & become a Unicorn ($1B market cap). But you can’t sell 10% of your company's production for $500M & become a FORTUNE 500 corporation ($5B revenue). Ergo I find rankings of company size based on market cap a bit flaky.

— GTM360 (@GTM360) June 20, 2019

If, at this stage, you’re wondering why this list matters at all, I refer you to How Relevant Is FORTUNE 500 In Today’s World?. I wrote this blog post last year in response to somebody who wondered the same after reading my 2019 post entitled TCS Is Within Striking Distance Of FORTUNE GLOBAL 500 – Even Without M&A.

Overview of Fortune Global 500 – 2020

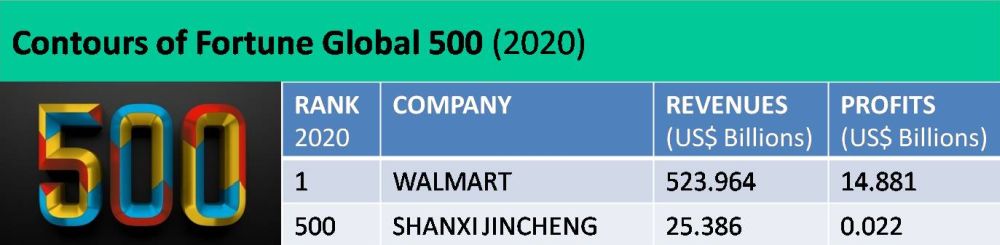

The world’s 500 largest companies generated $33.3 trillion in revenues and $2.1 trillion in profits in 2019. Together, this year’s Fortune Global 500 companies employ 69.9 million people worldwide and are represented by 32 countries.

The world’s 500 largest companies generated $33.3 trillion in revenues and $2.1 trillion in profits in 2019. Together, this year’s Fortune Global 500 companies employ 69.9 million people worldwide and are represented by 32 countries.

Based on the above figures, the fictitious Fortune Global 500 Inc. has the following attributes:

- Profitability: 6.31%

- Revenue Per Employee: $476,394

- Profit Per Employee: $30,043

The first entry on this year’s list gives me yet another opportunity to remind people that WALMART is not just America’s largest retailer or the world’s largest retailer but the largest company in the world.

The last entry is a new player called SHANXI JINCHENG ANTHRACITE COAL MINING GROUP from China.

Together they make up the contours of this year’s Fortune Global 500 list.

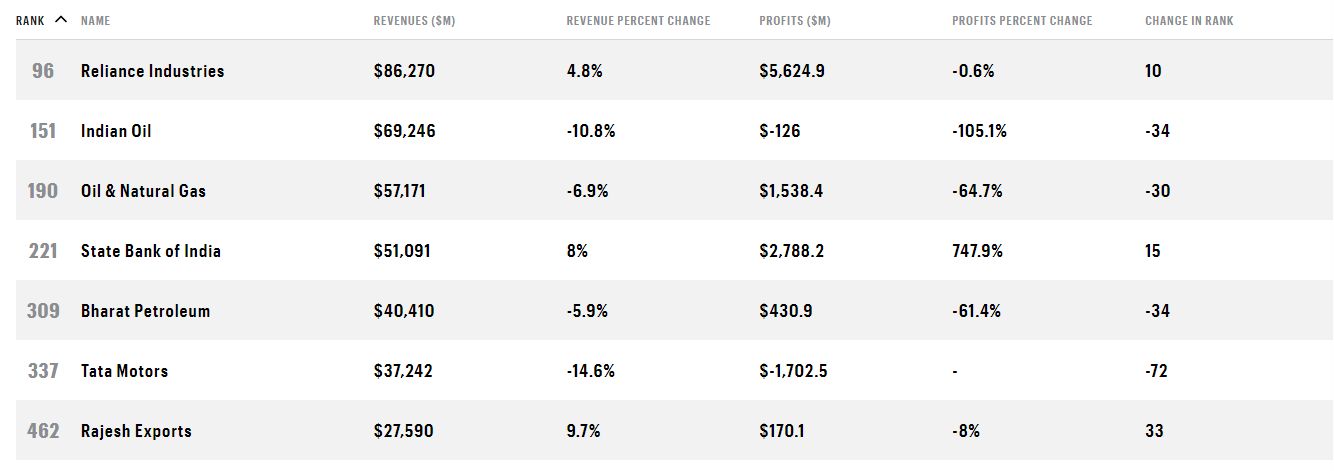

For as long as I can remember, India has had SEVEN Fortune Global 500 companies. This year is no exception, with RELIANCE at the top (#96) and RAJESH EXPORTS at the bottom (#462) of the list. All but the last firm are constant fixtures on the list for as long as I can remember.

The revenue of the 500th ranked company has grown from $24.796 billion last year to $25.386 billion this year i.e. by 2.38%. This marks the fifth year in a row that the FORTUNE GLOBAL 500 Qualifying Revenue has gone up from the previous year.

I’m guessing that coronavirus has not had any effect on FG500 Qualifying Revenue since it did not begin its disruption of the global economy until well after the period under consideration. It’s hard to predict its impact next year. Given that the pandemic has affected different industries differently, it might just displace some companies from this year’s list with new companies next year without upending the upward trend in the qualifying revenue. Let’s see what happens.

Indian IT Industry

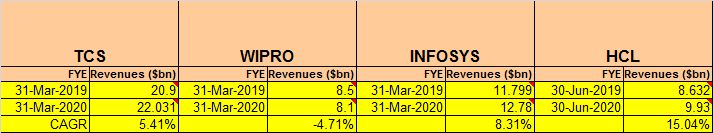

TCS, Infosys, HCL and Wipro continue to be frontrunners of the Indian IT industry. Their revenues for the current and previous year are shown in the following table:

I’ve extrapolated the respective current CAGRs of these four companies to forecast their revenues for the next 10 years and juxtaposed those against the projected FG500 Qualifying Revenues for the same period. This is a snapshot of the result:

Click here to download this model as an Excel Workbook (XLSX, 25KB).

Here are the highlights:

- Three out of the four leading companies grew faster than the Fortune Global 500 Qualifying Revenue (CAGR 2.38%). Like last year, the sole exception is Wipro. It pains me to say that my alma mater’s situation has gone from bad to worse this year (relatively speaking). Last year, Wipro grew slower than FG500 Qualifying Revenue – but nonetheless had positive growth. This year, it shrank. In other words, Wipro’s revenue declined. But you may not get that impression if you read the company’s regulatory filings. More on that in a bit.

- TCS has slipped from last year. Its ETA into FG500 has been pushed out from 2024 to 2025. For reasons noted earlier, we can’t attribute this to the pandemic outbreak.

- HCL has emerged as the dark horse. As I predicted last year, HCL overtook Wipro a few months after I released my forecast. At its current scorching rate of growth of 15%, HCL will overtake Infosys in 2025, become a FORTUNE GLOBAL 500 corporation in 2029 and overtake TCS the following year. While I haven’t done a teardown of its financials, it’s reasonable to expect that a sizeable chunk of the company’s growth has come from its M&A initiatives.

- I’ve been seeing M&A as a major growth driver for Indian IT industry for several years. I’m glad to find a company that has taken that path to rapid growth. If HCL continues to leverage M&A in the future, I have no doubt that it will be able to sustain its 15% CAGR going forward.

- A word on Wipro’s reporting. The company reported revenues of $8.5B last year (Source FYE 2019) and $8.1B this year (Source FYE2020). That means a 4.71% decline. But the company still claims a increase of 4.1% in its regulatory filings. Which is obviously wrong. The explanation given in the footnote is lame, especially considering that Wipro bills an overwhelming majority of its revenues in foreign currency. I find this sleight of hand a bit – um – intriguing for a company that was hailed as the bedrock of integrity when I used to work there in the early 90s. When people notice two consecutive years of poor performance and place sharp practices side-by-side, they tend to connect the dots the wrong way. I hope the company issues a corrigendum revising its dollar growth rate. Otherwise, it risks reputation damage, at least among the analyst community. Anyway, I have ignored the wrong growth rate reported by the company and used the correct CAGR of -4.71% in my forecasting model.

As in the past, TCS continues to be the most likely Indian IT company to enter the Fortune Global 500 league table – with or without M&A. From this year, we also have another contender for the distinction: HCL – especially with M&A.

On top of that, the assymetric nature of the pandemic’s impact may deliver some pleasant surprises. It’s widely believed that coronavirus has dealt a more severe blow to industries like manufacturing, retail and hospitality than technology. While this might sound insensitive, I’d be amiss if I failed to point out that the frontrunners of the Indian IT industry might face diminished competition from companies in those affected industries for a place in the much vaunted Fortune Global 500 list.