In the past few days, several startups in India have received notices from the Income Tax Department threatening penal taxes on the angel investments (“Angel Tax”) raised by them during the past few years.

Angel tax demon is back! Number of entrepreneurs have received I-T notices over Angel funding. This even as FM @ArunJaitley & @DIPPGOI gave clarity on not taxing early stage fundraising. Notices are demanding 30% of Angel money raised as tax.@sreejithmoolayl @padmajaian @abezack pic.twitter.com/CaQW3sVsfG

— ET NOW (@ETNOWlive) December 18, 2018

The startup world has lit up Twitter and the mainstream media with protests against what it considers draconian measures by the government.

It’s still early days. While the narrative can shift in the coming days, the startup community’s current protest against the ITD’s move rests on the following arguments:

- This will stifle innovation

- Startups are valued on ideas whereas the ITD is still stuck with old-school valuation methods based on assets.

I believe this narrative stands on very shaky grounds. And I say this as an angel investor.

Even subscribing to the generous view that all startups are innovative, that doesn’t condone transgression, if any, of tax laws by them. I say this not only on principle but also for practical reasons. If startups seek special tax dispensation on the ground of innovation today, manufacturers may seek special tax dispensation on the ground of Make in India or some other noble cause tomorrow. That’s a slippery slope that the government shouldn’t fall into. (Some may argue that the government has already fallen into the slippery slope of farmer loan waivers post the recent Assembly Election results, so what’s one more slippery slope. While there’s merit in that argument, that’s a story for another day).

Then, take basis of valuation.

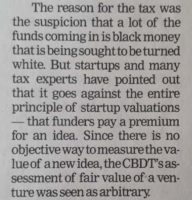

I’ve noticed that most startups in India are valued at INR 8 crores (US$ 1.2 million) at their seed round. That’s not a small sum. The startup community is trying to make the case that the entire principle of startup valuations is that funders pay a premium for an idea. That’s a tough sell. Many Chartered Accountants in my own extended family and friends circle fail to understand how a startup can enjoy such a high valuation when it has no revenues or profits. (For reference, the corresponding figure for an American startup is a similarly mouth-watering number of US$ 8 million). Against that backdrop, it’s a little naive for the startup community to expect Income Tax Assessment Officers to accept their valuation-for-idea argument, especially when doing so would run counter to the ITD’s vested interest in pursuing its claim of angel tax.

Both these arguments of the startup community are non tenable.

In my opinion, the community must shift its focus to the one undisputable fact in this whole subject, which is that investors have invested their hard-earned money at the said valuations. That’s all that counts.

End of the day, valuation is between buyer and seller – entrepreneur and angel investor in this case.

So what should the startup community do?

In my opinion, startups and angels should shift the narrative to the genuineness of the funds. It’s in everyone’s interest to ensure that startups are not used as money laundering agencies.

I’m sure entrepreneurs, angel investors and tax officials are all in agreement on that basic – or even the only – goal of this entire exercise.

In line with that, ITD should focus all its efforts on establishing that the money received by startups in their angel rounds is kosher. They should do it in such a way without diverting entrepreneurs too much from their day – and, sometimes, also night! – job of running their startups.