Continuing from my previous post titled GST For Normies – Part 1, I’m covering some of the more complicated elements of GST in this follow on post. As before, this is not taxation, accounting or legal advice. The rest of the preamble from Part-1 applies here too. But I want to amplify my previous point about jargon.

Every field has its own jargon. GST is no exception. While many people rant against jargon, it’s impossible – even inadvisable – to avoid jargon while discussing any specialized topic. According to one study, a six page standard credit card agreement ballooned to 24 pages when stripped off the jargon. So, we’ll have to live with GST jargon.

That said, I’ve found a few terms used by CAs and third-party GST websites that are ambiguous or downright contradictory. Maybe accountants and compliance officers will make sense out of them as they are but I’ve recasted those terms in a form that would make more sense to a businessman (“normie”).

With that bit of housekeeping out of the way, here goes my second installment of random rambling on GST.

INPUT TAX CREDIT

Like VAT and Service Tax that came before it, GST is a value-added tax. That is, a business is liable for the tax only on the value added by it.

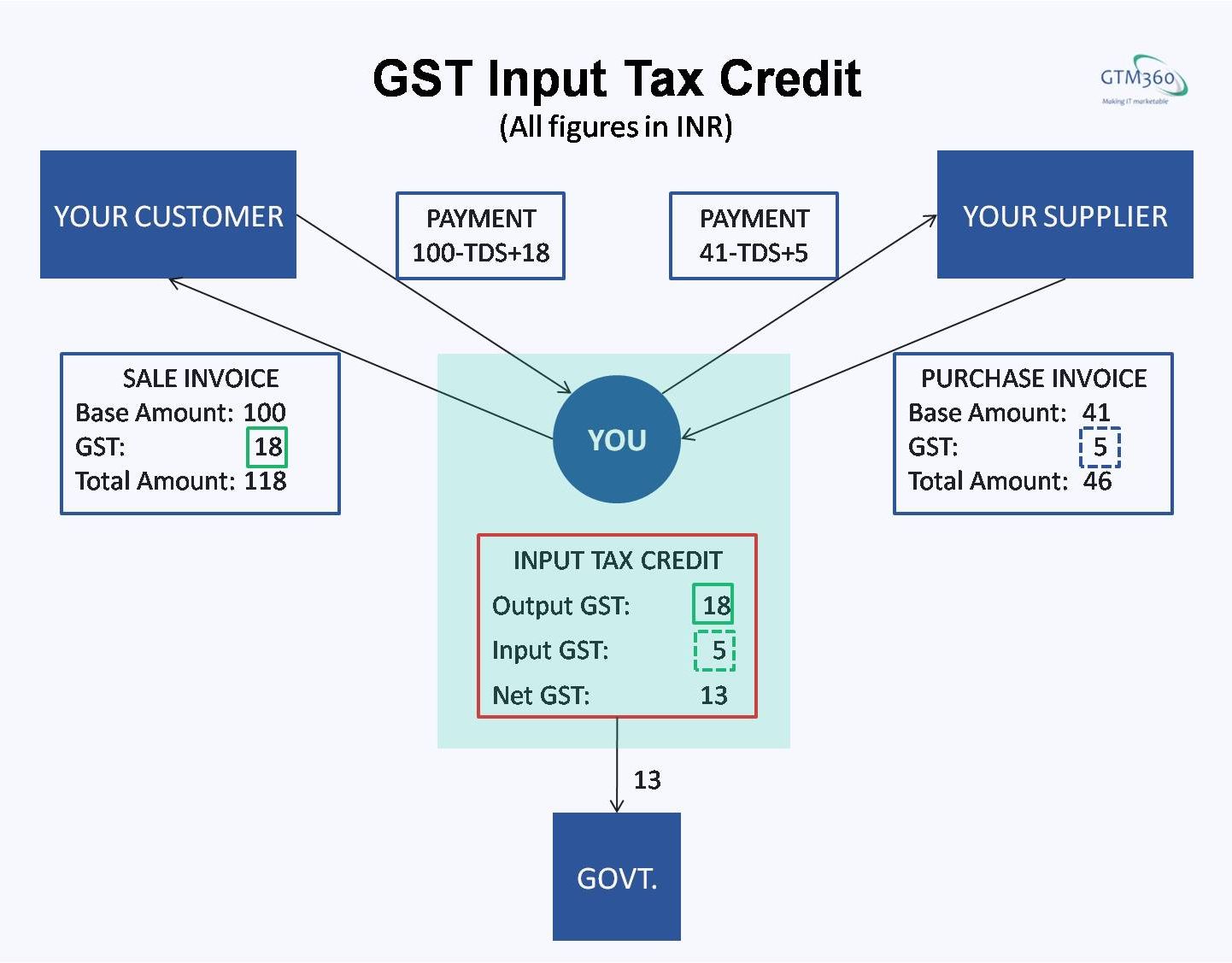

This means that you, as a GST registered entity, can claim refund of the GST you’ve paid to your suppliers (called “tax on input” in GST lingo). This is illustrated in the following exhibit.

The actual process of claiming back the GST paid out is called Input Tax Credit (ITC).

The following conditions are necessary to claim ITC:

- Your supplier must be a GST Co and issue a B2B GST invoice i.e. the invoice must mention the supplier’s name and GSTIN as well as your company’s name and GSTIN

- You must verify that the supplier’s GSTIN stated on the GST Invoice is valid. When in doubt, use the Search Taxpayer feature on the GST Portal.

But these are only the necessary, but not sufficient, conditions to claim ITC.

That’s because, just because you’ve paid GST to a certain supplier does not mean you can deduct it from the GST you collect from your customer (called “tax on output” in GST lingo) and remit only the net amount to the government. To that extent, the above exhibit is more an illustration of the principle of ITC.

The way it works in practice, it’s the GST Portal that does the netting of input tax (or not). You can get your ITC only if your supplier has remitted the GST he has collected from you to the government.

Which brings us to the obvious question: What happens if your supplier fails to remit the GST he has collected from you to the government?

You can’t claim ITC. Period. If it sounds unfair, that’s because it is.

What recourse do you have under this situation?

It’s too early to say but, in all likelihood, very little:

- The government will tell you to chase your supplier to remit the GST to the government

- Your supplier will tell you to mind your own business

- Your CA will rule out the possibility of such a thing happening. He’ll quote chapter and verse of GST law. He’ll tell you that the supplier will get fined if he doesn’t pay up the collected GST by so-and-so date, blah blah blah. But he’ll not tell you what you can do if, despite everything, your suppliers do engage in such wrongdoings.

If you’ve been in business for a few years, you’d have heard about the Kingfishers of the world who deduct TDS from their employees’ salaries and fail to remit the withheld money to the government for years and the Income Tax Department chases the employees to pay Income Tax again.

So, while I hope our CAs are right and that I’m wrong, I won’t rule out some fireworks on this front going forward.

With the basics of ITC out of the way, here’s how you can benefit from it.

If you look closely at your expenses, you might find that there are many items you use for your business but pay from your own pocket. These include office supplies, snacks and beverages, mobile phone connection, travel and such relatively small-ticket items for which you get bills in your name and submit them to your company for reimbursement.

If these bills continue to be made out in your personal name, you won’t be able to claim ITC of the GST you pay on them (since private individuals are not eligible to claim ITC). Therefore, you might want to get B2B GST Invoices for these items in your company’s name so that you can claim ITC.

I’ve had a mixed experience on getting B2B GST Invoices, depending upon the supplier involved. I’ve come across the following four types of GST Co suppliers in the last four months of GST regime:

- S1: Suppliers who will gladly issue a B2B GST Invoice if you simply tell them your company name and GSTIN e.g. VistaPrint, Venus Stationers

- S2: Suppliers who will issue a B2B GST Invoice but only after you get your account transferred from your personal to your company name e.g. Mobile Network Operators. Going by my personal experience with the MNO described in Why Does Negative Content Work?, you might have to jump through several hoops to complete this step

- S3: Suppliers who issue an invoice labeled “GST Invoice” but the invoice neither mentions their GSTIN nor contains any details of GST taxes levied e.g. The Paper Store. I’m not sure if these companies are to be treated as GST Co or Non-GST Co suppliers when it comes to ITC

Hey @ThePaperStore : How can you call it GST INVOICE when it doesn't display your GSTIN? pic.twitter.com/xn9BFx2tAj

— Ketharaman Swaminathan (@s_ketharaman) September 20, 2017

- S4: Suppliers who collect GST from you but refuse to issue a GST Invoice e.g. TWS SYSTEMS PVT LTD. (Tofler).

Based on my experience, I’m happy to share the following tips while dealing with each of the aforementioned category of suppliers:

- #ProTip for S1: Carry a copy of your GST Registration Certification in your wallet or smartphone so that you can quote your GSTIN at checkout whenever you’re buying something for your company from these suppliers

- #ProTip for S2: Take a call whether the ITC earned is really worth the time spent on effecting the transfer of the account from your personal to company name

- #ProTip for S3: Avoid these suppliers as far as possible

- #ProTip for S4: Don’t touch these suppliers with a forty feet bargepole. IMO, they’re close to daylight robbers. I’ve complained about one of them to GST Council but I haven’t heard back.

GST FOR SERVICES EXPORTS

VAT was applicable for export of goods. But Service Tax was not applicable for export of services. Now, GST is applicable for exports of both products and services. As stated earlier, GST registration is mandatory for anyone engaged in exports (even if they’re below the minimum turnover threshold).

VAT was applicable for export of goods. But Service Tax was not applicable for export of services. Now, GST is applicable for exports of both products and services. As stated earlier, GST registration is mandatory for anyone engaged in exports (even if they’re below the minimum turnover threshold).

One CA firm tells me that the GST rate for export of Services is 0% (as against 18% for domestic sale of Services). Whereas another CA firm maintains that the GST rate for services is the same for both domestic and export sales i.e. 18%.

But both confirm that you can sidestep the incidence of GST for export of services by filing a Letter of Undertaking (if your Annual Turnover > INR 1 crore) or Bond (Annual Turnover < INR 1 crore). I’m in the midst of figuring this out and will update this post once I have it bedded down.

REVERSE CHARGE MECHANISM

Reverse Charge Mechanism (RCM) is arguably the most controversial provision of GST.

Normally, if you buy anything from a GST Co supplier, he’ll add GST to his bill. You’ll pay the base price and the GST to the supplier. The supplier will retain the base price and remit the GST to the government.

Now, if you buy the same stuff from a Non-GST Co, the supplier won’t add GST to his bill. You’ll pay only the base price to the supplier. The government will be short the GST tax.

To make up for this loss, the government makes you, the buyer, liable for GST. In other words, according to RCM, you pay GST on behalf of your Non-GST Co supplier.

Sounds draconian, right?

On first blush, yes.

But not so much if you dig a little deeper. Because:

- RCM is applicable only if you buy more than INR 5000 worth of goods / services from one or more Non-GST Cos in a single calendar day

- AFAIK, there’s nothing stopping you from splitting such purchases across multiple days such that the total spend on Non-GST Cos does not exceed the daily cap of INR 5K, thereby releasing you from the RCM obligation

- Whatever you pay as RCM can be claimed back via ITC. So, RCM is more a cashflow than a cost issue.

- Even if you don’t have enough revenues and, accordingly, high enough output GST amount from which to net off RCM, no problem: RCM never lapses and you have until eternity to claim it back via ITC

- Last, but not the least, you might be able to shift virtually all your purchases from Non-GST Cos to GST Cos, thereby getting out of the ambit of RCM altogether.

But the point has temporarily become moot: According to the amendments to GST announced on 6 October 2017, RCM has been put on hold until 31 March 2018.

That’s it.

Hope you found my random ramblings on GST useful in running your business.

In case you want me to amplify any of the points covered in my two posts or have any other insights on how GST works for an IT business, please share in the comments below.