In Mobile Wallets Should Fix What’s Broken – And It Ain’t Payments, we saw why consumers were more likely to try out mobile wallets for store loyalty cards than debit or credit cards.

In this post, we’ll go beyond initial adoption and see where these two mobile wallet use cases – “mobile loyalty” and “mobile payment” respectively – stand with respect to sustained usage.

On that count, early adopters will be forced back to plastic if not enough merchants accepted mobile wallets or they found mobile wallets cumbersome, or both. Therefore, merchant acceptance and user experience are two critical success factors for the ongoing use of mobile wallets.

Let’s see how mobile loyalty compares with mobile payment on these CSFs.

Merchant Acceptance

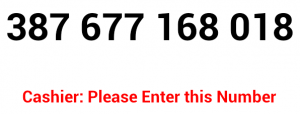

I won’t complain if you use my loyalty card and credit rewards for your shopping to my account. The very nature of loyalty programs creates a strong incentive to use one’s own loyalty card and a strong disincentive to use somebody else’s loyalty card. As a result, loyalty card transactions don’t need a signature or PIN. Simply reciting the loyalty # off of the loyalty app should suffice to credit rewards. Therefore, mobile loyalty apps will enjoy sustained usage even if a merchant can’t or won’t install special equipment required to read loyalty card details off of smartphone screens.

On the other hand, in-store plastic debit and credit card transactions require PIN / signature and swipe / dip. Merchants have invested in the requisite infrastructure for handling plastic payment cards decades ago. For them to now consider accepting mobile payments, they need to invest in additional equipment to scan payment cards off of smartphones (via NFC, QR code or Bluetooth or equivalent). That’s a big hurdle for widespread adoption of mobile payments. As if that were not enough, merchants also have to contend with higher processing fees for accepting mobile payments since such transactions are classified as Card Not Present, which attracts higher interchange rates. Therefore, merchants face a double whammy while accepting mobile wallets for payments.

User Experience

In-store use of both mobile loyalty and mobile payments entail the user to fire up the app and select the appropriate card from among the many cards saved on the app. The time taken for these steps depends upon highly variable factors like the smartphone model and the number of cards saved on the mobile wallet. As a result, the jury is out on whether mobile wallets slow down the in-store checkout process or not.

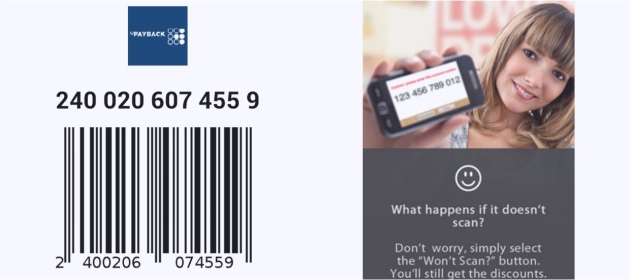

That said, the very nature of loyalty programs makes it easier to mitigate potential checkout delays since there’s only one loyalty card that’s ‘appropriate’ for a given store e.g. Subcard at Subway or PAYBACK at Big Bazaar. A location based mobile wallet app like Apple Passbook can save time by automatically selecting the correct loyalty card at a given store location. The same is not so straightforward in the case of a payment card where any (open loop) card would work at any store, thereby undermining the notion of ‘appropriate card’.

The above comparison makes it clear that mobile wallets fare better on both merchant acceptance and user experience when they’re positioned at store loyalty cards rather than debit or credit cards. This signals a brighter outlook for sustained usage and mainstream adoption of mobile loyalty as against mobile payment.

UPDATE DATED 22 JULY 2020:

It’s seven years since the above post was published. An increasing number of retailers have begun accepting the consumer’s mobile phone # as proxy for loyalty membership #. In fact, many of them have stopped issuing plastic loyalty cards and membership numbers. As a result, mobile apps to digitize plastic loyalty cards have become moot. In the original post, I predicted that it was enough to speak out the loyalty # to earn rewards. Well, now consumers earn rewards by just reciting their mobile phone # at checkout. Regarding payments, mobile wallets have enjoyed a better run as cash replacement (rather than credit card replacement), egged on by Black Swan events like re/demonetization of high value currency notes in India in 2016 and the resultant severe cash crunch, coronavirus pandemic in 2020 and the ensuing caution among consumers to avoid contact entailed during cash and non-contactless plastic credit card / debit card payments. And also the ability of mobile payment providers to waive processing fees for years on end, and manage to subsidize the losses via venture capital funding.