My recent post The Tug-of-War Between Different Pricing Models sparked a lively debate and attracted several comments and 1-on-1 feedback about whether customers care about costs or not.

My recent post The Tug-of-War Between Different Pricing Models sparked a lively debate and attracted several comments and 1-on-1 feedback about whether customers care about costs or not.

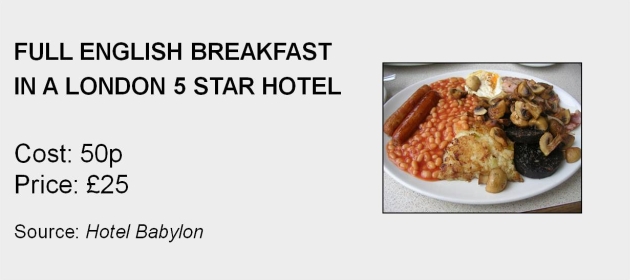

Some people believe that buyers are only interested in the value they receive from a product and are least bothered about how much it costs a manufacturer to produce it. It’s thanks to such buyers that five star hotels – and many other industries – can get away with their exorbitant prices. For example, a typical London 5* hotel charges £25 for a full English breakfast although its cost is less than 50p (Source: Hotel Babylon).

On the other hand, others believe that customers do care about costs.

Take, for example, the author of this Economic Times article who argues that Indian Railways is not justified in charging a higher price for return trips on trains. To give a bit of background, train tickets are always issued for one-way journeys. This is unlike air tickets where round trip booking is common and one-way trips are sometimes not even permitted. By issuing a return ticket, Indian Railways is certainly delivering convenience. But the consumer activist author of the article refuses to accept a premium for a return ticket. His sole argument against premium is that the supplier – Indian Railways – is incurring no extra cost to issue a return ticket. In short, he is caring about costs.

Of course, you could argue that this guy is an outlier since he’s not just a consumer but a consumer activist, a tribe whose job is to poke its nose into things like cost.

I concede that, whether or not customers worry about costs is a cultural thing and could vary from one country to another.

That said, the way the governments and regulators approach this topic seems uniform in many parts of the world. In a true laissez-faire economy, governments shouldn’t be involved in the business of business, let alone get into prices charged by private players. However, in the real world, they do. Especially in regulated industries like banking, healthcare, and so on.

Even in a Mecca of free market like the USA, there has been a spate of legislation in recent times around banking fees and charges. According to Dodd-Frank-Durbin Act, banks can charge a maximum of 24 cents per debit card transaction. While enacting this law, the lawmakers specifically linked price to cost and noted that fees for debit card transactions should be “reasonable” in comparison to the cost of processing them. Other examples where prices are set on the basis of costs are credit card APR limits (US CARD Act), overdraft charges on checking / current accounts (USA, UK) and insurance premiums (Germany, India).

So, whether customers care about costs or not, regulators do.