I once argued that Banks Will Never Catch Up With Fintechs On UX.

Since then, I’ve seen some improvements in the user experience of banking apps.

My go-to

- Payment app has reduced PIN to four digits (from six)

- Stock trading app keeps me logged in the whole day (instead of logging me out after five minutes of inactivity)

- Netbanking portal has changed the IMPS and NEFT payment workflows to make them more intuitive.

However, there are many other areas in which friction in banking processes and applications has shot up.

Here’s a partial list of friction hotspots in branch and digital banking that I’ve experienced firsthand in the last 9-12 months.

1. Credit Card Activation

I’ve ranted against the friction in activating renewed credit cards in the past here. Going by my recent experience with two renewals, the CX has become worse.

I recently received two renewed credit cards (primary and addon). As before, the letters accompanying the renewed credit cards listed several channels for activating them and setting the PIN.

The first channel I tried was telephone. The CSR activated my credit card but told me to use chat channel to set my PIN. I was able to set the PIN for my primary card on chat but the chatbot told me to use a third channel – phonebanking but with a different telephone number – to set the PIN for my addon card. The IVR phonetree confirmed that it had activated the addon card and told me to await the PIN, which would be sent by SMS within 24 hours. Many months later, I’ve not received the said PIN.

I have no time or patience to follow up, so I’ve abandoned the secondary credit card. This is no skin off my back since we’ve many other credit cards in the family, so the bank is the one that will lose interchange revenue due to non usage of the addon card.

PIN Delivery for Debit/Credit Card is canonical example of banks screwing up a physical process with Brute Force Digitalization.

But greenwashed consumers are also to blame for deriding the smoothly-functioning PIN Mailer process because it used paper. https://t.co/wfW3ltwGe9— Ketharaman Swaminathan (@s_ketharaman) September 2, 2022

My latest experience reinforces what I’ve said many times before: The good old PIN mailer sent by post / courier worked better.

2. RBI Emandate

I’ve ranted about the friction involved in canceling a credit card recurring payment here.

On my latest visit to the so-called SIhub to cancel an emandate, as usual, my cancelation request failed to go through on the first attempt. I’d to try again to make it work. In addition, I found many additional sources of friction on this website:

- Password must have special characters

- Need to change password every 90 days

- Crack CAPTCHA

- OTP

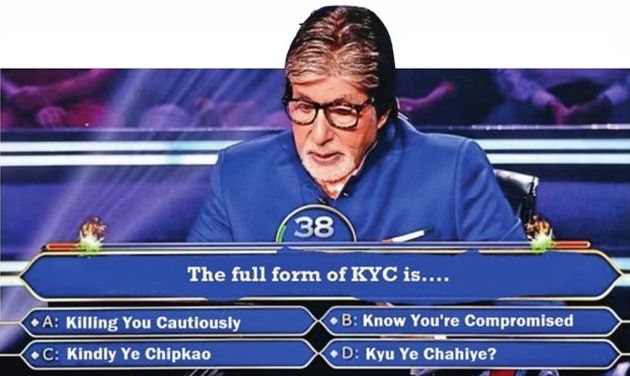

3. REKYC

For a long time, we’ve had to REKYC our bank accounts once in two years or so. It has always been a major PITA for several reasons:

- You must visit the branch, that too the “home branch” where you opened your account.

- You must ensure exact match in first name, last name, and other KYC data fields.

Of late, the REKYC tyranny has scaled new heights. According to a recent Economic Times oped entitled KYC, Unlock Kar Diya Jaye:

The ‘tyranny of KYC’ seems to be getting worse. In 27 of the 72 households surveyed, at least one member was unable to withdraw money from their own bank account. In most cases, this was due to KYC issues. In a neighboring district, the situation there was even worse: 69% of households were shut out of at least one bank account. The root cause of this crisis is that KYC norms keep getting more stringent, even as Aadhaar correction options get more restrictive. The slightest discrepancy between a person’s Aadhaar card and bank passbook can easily lead to the rejection of a KYC application.

With rampant rejections of applications, REKYC is no longer a “mere formality” that will “work out fine in the end”. I’m not as sure, as I once was, that Warts And All, The Banking System Works.

The remit of REKYC has now extended to other financial products like insurance, stock trading, and so on.

4. RE REKYC

No, that’s not a typo.

I jumped through several hoops to complete the REKYC for my stock trading / DEMAT account.

A few months later, when I tried to redeem a SIP administered by the same platform, I was blocked. Apparently, the REKYC I’d done earlier was only for the equity part of the account, now I had to do a separate REKYC for my mutual funds.

“These are disastrous numbers” ~ @dhirendra_vr .

Finally research shows that most mutual funds are toxic assets / weapons of mass financial destruction. #Sensex #ETF pic.twitter.com/2BiyQVnEhH— Ketharaman Swaminathan (@s_ketharaman) August 24, 2023

Always a skeptic of mutual funds, I used this as an excuse to liquidate my mutual fund portfolio and park my funds in Sensex ETF.

I’ve covered four friction hotspots in this post. In a follow-on post, we’ll see four more.

Watch this space!