This has been a year of big ticket M&A in the Indian IT industry. While the acquisitions haven’t put any Indian IT company on the FORTUNE GLOBAL 500 list yet, for the first time since I started writing this annual post around a decade ago, I’m convinced that M&A will propel the Indian IT industry into this august list sooner rather than later.

This has been a year of big ticket M&A in the Indian IT industry. While the acquisitions haven’t put any Indian IT company on the FORTUNE GLOBAL 500 list yet, for the first time since I started writing this annual post around a decade ago, I’m convinced that M&A will propel the Indian IT industry into this august list sooner rather than later.

Before I do a deep dive on that subject, here’s a quick overview of the list of 500 largest global corporations published by FORTUNE magazine earlier this month.

FORTUNE GLOBAL 500

The top 500 corporations in the world posted record-breaking aggregate revenues of $41 trillion, which represents more than one-third of global GDP.

The mean Fortune Global 500 corporation has a revenue of $82 billion.

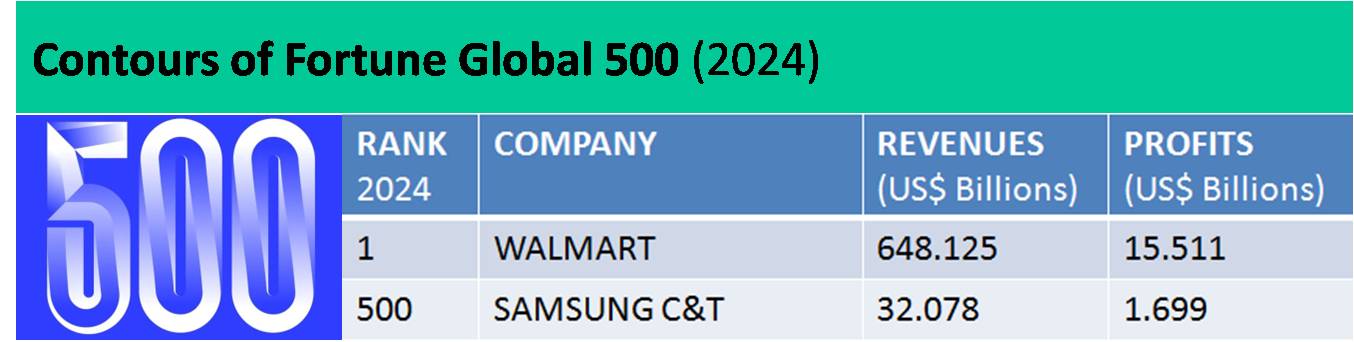

Walmart remains #1 on the list for the 11th consecutive year. The 500th company on the list is Samsung C&T. Together, the two companies bring up the contours of Fortune Global 500:

Amazon reaches a new high and claims the #2 spot (up from #4 last year).

Saudi Aramco falls to #4; however, with $121B in profits, it is the most profitable company on the list for the third year in a row.

Despite negligible year-on-year revenue growth (0.1%), the Global 500 companies had their second-most profitable year ever, minting $2.97T in profits – Saudi Aramco (#4) being the most profitable with #7 Apple coming in second.

Despite negligible year-on-year revenue growth (0.1%), the Global 500 companies had their second-most profitable year ever, minting $2.97T in profits – Saudi Aramco (#4) being the most profitable with #7 Apple coming in second.

Five sectors – Financials, Energy, Motor Vehicles and Parts, Technology, and Healthcare – account for 60% of the companies on the Global 500 and contributed 65% of the total revenue.

After a gap of six years (2018), USA’s presence (139 companies) on the Fortune Global 500 surpassed that of Greater China (133 companies).

INDIA IN FORTUNE GLOBAL 500

India has nine Fortune Global 500 companies, the largest being Reliance Industries (#86) and the smallest being Rajesh Exports (#463), with revenue of close to $109B and $34B respectively.

This is one more than the count last year. HDFC Bank is the new entrant, with a sharp growth of 93.4% in revenue resulting largely from the merger of the mortgage arm with the bank during the year.

Five of the companies on the list have posted decline in revenue this year (against none in 2023). It’s a real decline in the case of four of them (Indian Oil, Oil & Natural Gas, Bharat Petroleum, Rajesh Exports) and a notional decline due to depreciation of INR against USD in the case of one (Reliance Industries).

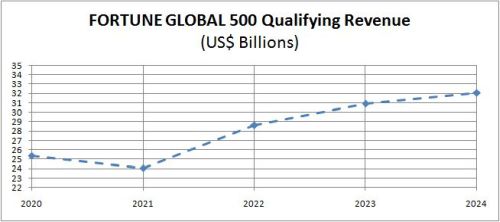

FORTUNE GLOBAL 500 QUALIFYING REVENUE

The Fortune Global 500 Qualifying Revenue rose by 3.74% to $32.078B.

For the uninitiated, Fortune Global 500 Qualifying Revenue is the revenue hurdle that a company must cross to enter the hallowed corridors of the 500 largest corporations in the world. In other words, it’s the revenue of the company ranked 500th on the list. FG500-QR has grown YoY every year in the last decade except in the lists published in 2016 and 2021.

INDIAN IT INDUSTRY

The Indian IT industry continues to be driven by services rather than product companies. As I’ve said repeatedly over the years, that’s not a bad thing.

Product and Services businesses have different characteristics. Success in one does not assure success in the other. As a doyen of the Indian IT industry said, “Tell Nadella to Create a TCS”.

This is equally true in FMCG industry.

HUL. Marico. pic.twitter.com/D7xFxgf5Kg— Ketharaman Swaminathan (@s_ketharaman) August 8, 2024

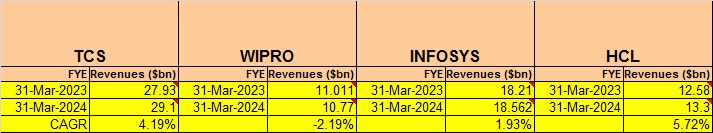

As in the past few years, TCS, Infosys, HCL and Wipro continue to occupy the top four spots in the Indian IT industry by revenues. The following exhibit shows their revenues for FYE2024 and FYE2023.

TCS (4.19%) and HCL (5.72%) have grown faster than the Fortune Global 500 Qualifying Revenue (3.74%) whereas Infosys (1.93%) and Wipro (-2.19%) have lagged behind.

With revenue of $29.1B, TCS is 9.28% behind FG500-QR of $32.078B. The gap has narrowed from 9.68% last year, with TCS’s sales growing faster (4.19%) than the qualifying revenue (3.74%) this year.

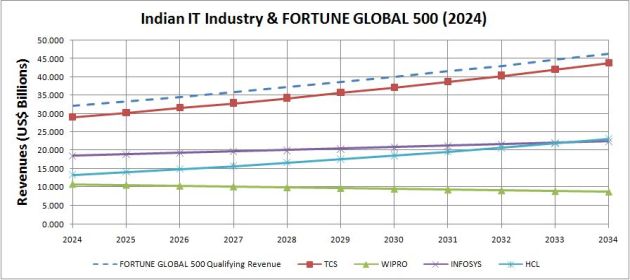

As in the past, I forecasted the revenues of the four companies for the next 10 years by extrapolating their current CAGRs and juxtaposed them with the projected FG500 Qualifying Revenue for the same period. The following chart is the result:

(Comment with “Excel” below if you’d like to get the Excel Model underpinning this forecast.)

The highlights of this forecast are as follows:

- If they grow at their respective present revenue CAGR, none of the four Indian IT companies in the model will become a Fortune Global 500 company during the entire model’s tenure through to 2034. The earliest that a company would enter the list is TCS in 2047.

- That said, using present CAGRs to extrapolate into the future might be misplaced in the year when the Indian IT industry has finally started doing billion dollar plus M&As, which will drive higher growth rates going forward.

For years, we’ve been predicting that the Indian IT industry will do some big ticket acquisitions. 2024 seems to be the year when those M&As are finally happening. https://t.co/RrYf9nEhda via @economictimes.

Adding to https://t.co/pU042m57sC. pic.twitter.com/4XJBSzExVz— Ketharaman Swaminathan (@s_ketharaman) June 14, 2024

- If the present surge of big ticket M&As continues, the question is not whether but when an Indian IT company will become a Fortune Global 500 corporation.

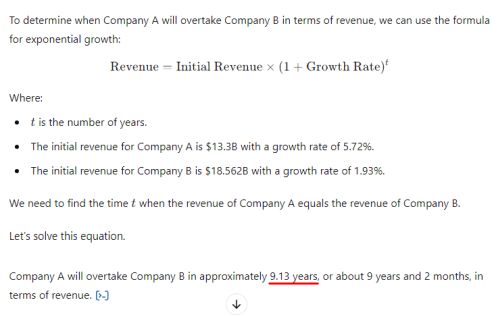

- HCL overtook Wipro two years ago. If it continues to grow at its industry-leading rate, HCL is on track to overtake Infosys in slightly over nine years, as is evident from the above chart. I double-checked this figure by solving the following equation from first principles: For what value of n will 13.3*1.0572^n = 18.562*1.0193^n.

- Just to test ChatGPT’s math skils, I prompted it with the following question:

- ChatGPT got the answer right.

- As I’ve feared for a long time, AI has reduced headcount in traditional ADM type projects by 15%. However, the industry has more than compensated for that loss by bagging new AI / GenAI projects that have driven 30% growth e.g. TCS – Xerox, Infosys – Danske, Wipro – Nokia (Source: Economic Times).

I’m thrilled that the Indian IT industry has transformed an existential threat like AI into a net positive – as it did Y2K, Internet, Web 2.0, Mobility, Cloud, Blockchain, and other disruptive technologies in the past. This speaks volumes of the innovativeness and resilience of the industry.