(This post is a slightly edited version of my answer to the above Quora question.)

When I pay my electricity bill on the utility company’s website or app, I’m using the so-called “Biller Direct” model whereas, when I pay the same bill on my bank’s website or app, I’m using the so-called “Bank Direct” model.

Under both models, bills can be paid manually or automatically.

In this post, we’ll be concerned about Bank Direct model. Under Bank Direct,

- Bill pay is when I pay every bill manually with my bank-issued credit card.

- Auto Bill Pay is when I register the utility with my bank and issue an omnibus mandate authorizing it to pay every bill with my credit card on file without seeking my consent for each and every bill.

Bills are “presented” to banks via bill networks e.g. Bharat Bill Payment System (BBPS) in India. In other words, the bill network publishes my electric bill to my bank so that I can pay it on the bank’s digital property.

Banks benefit a bit from bill pay and a lot auto bill pay. Let’s see how.

Benefits of Bill Pay

Banks get fees and data when I pay a bill with their credit card:

- Fees: Fees from the Biller aka Merchant. This is called Merchant Discount Rate (MDR) or Merchant Fees.

- Data: Depending on the terms of the merchant agreement, the bank may also be in a position to harvest bill metadata such as merchant category (food, apparel, hospitality), date of spend, and location.

I’ve always wondered why billers would pay a fees to banks for getting their bills paid. After all, there are only two reasons for a merchant to accept credit cards: (1) He will lose business otherwise (2) He will increase his ticket size by making the consumer overspend.

When all is said and done, there are only two reasons for a shopkeeper to accept credit card: (1) He will lose business if he does not (2) He will be able to make the customer overspend if he does. https://t.co/lEDrJ60Moj via @ValuePenguin

— GTM360 (@GTM360) August 24, 2018

Neither of these two reasons are applicable for paying a bill with credit card.

- By definition, a bill is a claim for payment for products / services already supplied. The business is already gained, only the payment is pending. In other words, bill pay is a non-discretionary spend as against a discretionary spend like, say, eating out. If I don’t pay the bill, the utility company will cut off my power supply.

- Whether I pay my bill with cash or credit card, I’m going to pay the amount shown on the bill, so credit card is not making me overspend, so the merchant is not boosting his AOV (Average Order Value) by letting me pay with credit card.

Neither driver for accepting credit card is present in the case of bill payments. Accordingly, I’ve concluded that billers accept credit card for bill payments only to enhance CX. But I digress.

Coming to data, banks can monetize it by running targeted ads off of it.

Suppose my monthly electricity bill is in the INR 4,000-6,000 ($50-$75) range. Then, one month, it shoots up to INR 12,000 ($150). As soon as I pay it, the bank will know that the bill is abnormally high. It can send me an advertisement for a power-sniffer product like the following targeted offer I recently saw on my electricity bill:

I might have seen several ads of this product in the past and ignored them because they were not relevant to me at the time. But, just after paying an outsized bill, the same product becomes highly relevant to me and I’m likely to be receptive to something that could help prevent a recurrence of a bill shock in future. (There are some companies that will intercede with the energy utility to work out an ex post facto discount even on the present bill.)

Since they’re highly relevant, these ads have way higher conversion rate than those in other popular channels like print, search, and so on (let alone spam). Accordingly, brands are willing to pay top dollar for them.

The combination of merchant fees and advertising revenues enabled by bill pay offers a decent source of revenue for banks, ergo they’re keen on getting their consumers to pay their bills through them.

The combination of merchant fees and advertising revenues enabled by bill pay offers a decent source of revenue for banks, ergo they’re keen on getting their consumers to pay their bills through them.

As you can see from the exhibit on the right, banks push bill pay aggressively on their online banking website (among other channels).

Benefits of Auto Bill Pay

Many customers have credit cards from multiple banks and may use any of those cards at random to pay a bill. As a result, a bank that earned merchant fees and advertising revenues from its consumer’s bill payment one month may lose the moolah to its competitor the following month.

To prevent that, many banks try to enroll their customers for auto bill pay, so that *their* credit card is used every time and *they* get to earn the mouthwatering revenues every month.

In the above example, had I set up my electricity bill for auto bill pay, my bank would have known about the outsized bill before me. Accordingly, it could have displayed the power-sniffer targeted ad along with the bill. That ad might have an even higher conversion rate than the one it sends after I pay the bill.

As you can see, there are several benefits of bill pay and auto bill pay – for the bank.

As you can see, there are several benefits of bill pay and auto bill pay – for the bank.

In marketing, you always focus on the customer. Accordingly, these benefits need to be projected from the customer perspective.

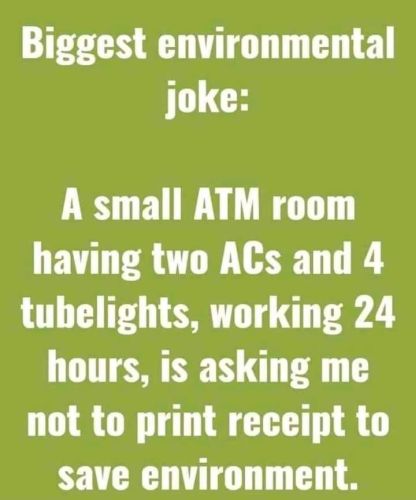

Banks save printing and postage costs with eBills and eStatements but they will promote paper turnoff by using greenwash like “Go Green” to make consumers feel cool about saving the planet.

Likewise, banks might push auto bill pay with consumer-centric messages like “Never forget to pay a bill on time”, “Enjoy peace of mind”, and “Don’t waste your time on mundane activities like bill payments”.