In this blog post, we’ll feature ten contradictions / ironies / disconnects aka #GoFigure.

1.

Trend driving Tech: Go from CAPEX to OPEX.

Trend driving Solar: Go from OPEX to CAPEX.

It’s amazing how these two contradictory trends can coexist in the same company at the same time e.g. IT seeks CxO approval for going from onprem to cloud whereas factory seeks CxO approval for installing solar to replace grid electricity.

2.

Google is a monopoly.

Google has 130,000 rivals.

3.

Bolt, Coinbase, Fast and other fintechs are firing.

Banks like Citi that they were supposed to disrupt are hiring.

4.

Companies: We’ll hand over customer data, strategy emails and confidential messages to AWS, Gmail, WhatsApp, et al.

Also Companies: We want private 5G so that we can preserve confidentiality of fan vibration, flue gas temperature, and steam pressure transmitted via 5G networks.

5.

Web: Go from Onprem to Cloud.

Mobile: Go from Cloud (mobile web) to Onprem (native app).

6.

Company: We hate vendor lock-in.

Also Company: We’re moving from multivendor onprem to AWS / Azure / GCP cloud oligopoly.

I can't think of a more free will action by IT customers to surrender their independence and lock themselves into a vendor oligopoly than their decision to migrate software systems from onprem to cloud.

Redux: Pied Piper of Hamelin.https://t.co/3NvMd468aO— GTM360 (@GTM360) December 15, 2022

7.

Crypto hasn’t killed Fiat. eBook hasn’t killed print book. EV hasn’t killed ICE. Fintech hasn’t killed Bank. Rideshare hasn’t killed Personal Vehicles.

But that hasn’t stopped the creation of billions of dollars in value by spreading the narrative that they will.

For the uninitiated, I’m alluding to the stratospheric valuation / market cap of wannabe disruptors like Block / Square, Coinbase, PayTM, Tesla, Uber, et al.

Lest somebody thought the current funding winter will put an end to that, I seriously doubt it.

VCs will talk about positive unit economics during bear runs but, once the bull run restarts, they will go back to funding loss-making startups. Exhibit A: AirBnB, RobinHood, Snap, Uber, WeWork, and many other poster childs of the last recession are making losses even after 10 years.

To some extent, I think FOMO in private markets has already commenced, just in one sector:

- OpenAI: $30M revenue, $29B valuation

- Character.ai: $0 revenue, $1B valuation.

8.

Indians won’t pay for convenience.

Indians won’t pay for convenience.

10X more Indians pay bills with UPI than Credit Card even though UPI is the costlier option.

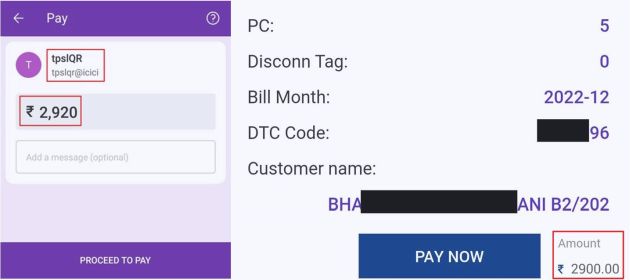

To take the example of an MSEB electricity bill:

UPI: INR 2920 via Walmart PhonePe

vs

Credit Card: INR 2900 via HDFC Bank PayZapp.

9.

Indians are supposed to be very price-sensitive and unwilling to pay a premium for brand.

However, Retail Private Label has only 5% market share in India (Basis: DMART INR 1587 crores/INR 30900 crores) despite being way cheaper than FMCG Brands.

10.

Publisher: We adhere to strict editorial integrity.

Publisher: We adhere to strict editorial integrity.

Also Publisher: Our products and services links are sponsored.

Exhibit A: You need to know how to package Hypocrisy – ahem Compartmentalization – to become a superpower.