All of us are familiar with the following subscriptions:

- Social network e.g. LinkedIn Premium

- Digital media e.g. Wall Street Journal

- Streaming video / OTT e.g. Netflix

- Hosting service e.g. Hostgator

- SAAS software e.g. Salesforce

A subscription is for a given plan at a fixed monthly fee. When you sign up for it, you typically submit details of your credit card (“Credit Card on File”) to a brand or service provider (“Merchant”). Terms and Conditions of most subscriptions include a so-called “auto debit electronic-mandate”, which authorizes the merchant to charge the fixed monthly fee to your credit card every month without taking your approval for each recurring payment.

PSA: Free Trial is a myth if you pay with Debit Card, UPI, etc. – your money leaves your bank account even before your trial has begun. OTOH, if you pay with Credit Card, free trial is truly free for the entire trial period. Source: @ETPrime_com pic.twitter.com/PIBaPBdi9V

— Ketharaman Swaminathan (@s_ketharaman) June 24, 2019

Many of us set up auto debits on our credit card or bank accounts to pay for electricity, cloud infrastructure, Google Ads, and other ongoing services. Their bills vary from one month to another. Therefore, they’re typically not treated as subscriptions. (As we saw above, in a subscription, monthly fees are typically fixed and agreed in advance.)

As we can see

All subscriptions are auto debit. But all auto debits are not subscription.

Cue to a few weeks or months after you signed up for a subscription. Let’s say:

- The free trial period has expired

- You’ve binge watched your favorite show OR your favorite show has suddenly become “unavailable”.

- You discover that paid does not mean ad-free, and you’ve had it with all the ads you still keep seeing (cf. chat transcript of this New York Times cancellation conversation).

In all these cases, you might not have any further need, want or desire for the subscription and might want to cancel it.

If you’re made to jump through many hoops at this stage – or, in the worst case, you’re not able to cancel at all – you’ve fallen into the so-called Subscription Trap.

From personal experience and anecdotal evidence, here are the challenges you might face while trying to cancel a subscription:

- You hit the cancel button on the website. Instead of receiving an instant confirmation that your subscription is cancelled, you’re ferried around from one screen to another with all kinds of dumb questions and confusing error messages. Alternatively, a chatbot pops up and gives you all kinds of advice on how to avoid the problems you’re facing that led you to cancel the subscription (e.g. how to turn off ads).

It is really hard to cancel a @nytimes subscription.

There should be a law requiring easy cancellation of any consumer subscription. pic.twitter.com/AUzRf7TdhY

— Sheel Mohnot (@pitdesi) February 18, 2021

- There’s no CANCEL button on the website. Although you bought the subscription online, you need to call a Hong Kong / Argentina number to cancel it. When you burn through costly ISD call rates, you’re put on hold for 30 minutes, and then subject to all kinds of cross sells for another 15 minutes before the CSR processes your cancellation request.

WSJ made me call from Argentina and talk with someone for ten minutes or so just to cancel my digital subscription. I felt stupid for being so naive. Never again.

— Pato Molina (@patriciomolina) January 9, 2020

- You’re locked out of the website. Forget about cancelling the service, you can’t even enjoy what you’re paying for. Click here for a couple of examples of service providers who engage in this most egregious form of subscription trap. Special place in hell for them.

- You’re told to send your cancellation request in writing to an email address that doesn’t – ahem – accept incoming emails.

@incfact I wish to cancel my service and the monthly payments. Can you please get in touch asap? I have been trying to get in touch with the "Support" team through email – but to no avail. My email ID is sam@cusp.services and the acct is linked to that. 🙌

— mbsam (@RevUpRevenues) February 3, 2021

- The only way to cancel is to send your ID proof by snail mail to an address in Scottsdale, Arizona, and wait for months to hear back.

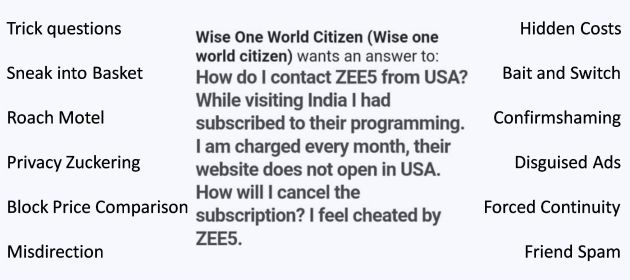

The technical term for the hoops you’re made to jump through in the aforementioned situations is Dark Pattern a/k/a user interfaces designed to trick consumers.

The most common type of Dark Pattern is Roach Motel. Derived from the iconic line “you can check in anytime but you can’t check out” in the classic rock number Hotel California, Roach Motel is ubiquitous and is present in all of the above illustrations of subscription trap. Other common Dark Patterns are Sneak into Basket and Bait and Switch. Click here for the full list of dark patterns.

According to a study by Princeton University, over 11% of websites use dark patterns. What’s more alarming, reputed brands use more dark patterns than non-reputed brands!

If you thought Dark Pattern is a 1% problem, think again. A study of 11K shopping websites found dark patterns in 1254 of them i.e. 11.1%.

Also:

* More reputed companies use more – not less – dark patterns

* Dark Pattern As A Service is a thing. https://t.co/FVii8DhKmw— Ketharaman Swaminathan (@s_ketharaman) March 2, 2021

I don’t want to sound alarmist but subscription traps are quite common these days.

Subscription Trap Fraud: People buy what they think is a free trial of a product but unwittingly get signed up for a pricey monthly subscription that uses #RoachMotel tactic to become virtually impossible to cancel. https://t.co/McoXV4REQg

— Ketharaman Swaminathan (@s_ketharaman) November 14, 2019

Because they can drain your credit card or bank account, nobody wants to be caught in subscription traps.

Good news is, it’s possible to escape subscription traps. We’ll explore ways to do that in a follow-on post.

Watch this space!