The fragmented state of the banking industry and, arguably, the relatively conservative policies of the Indian banking regulator Reserve Bank of India, have kept the assets of Indian banks somewhat subdued compared to their global peers. Not surprisingly, league tables of the global banking industry that use asset as the benchmark to rank banks, have never featured an Indian bank.

The fragmented state of the banking industry and, arguably, the relatively conservative policies of the Indian banking regulator Reserve Bank of India, have kept the assets of Indian banks somewhat subdued compared to their global peers. Not surprisingly, league tables of the global banking industry that use asset as the benchmark to rank banks, have never featured an Indian bank.

Enter FORTUNE GLOBAL 500 and State Bank of India.

Since it spans multiple industries, the FORTUNE magazine uses revenues – not assets – to measure a company’s size.

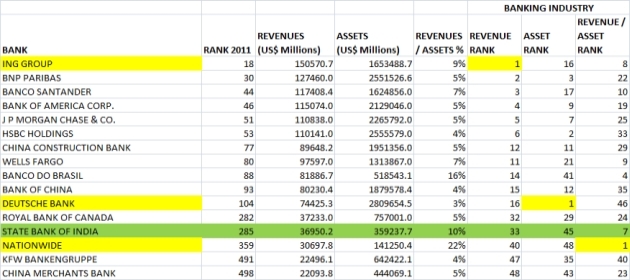

On this metric, the latest FORTUNE GLOBAL 500 list published on 23 July 2012* ranks India’s largest bank SBI as the 285th largest corporation in the world. My industry analysis – more on that in a bit – shows that SBI is placed at the 33rd spot among 48 banks that feature on this fabled list of the world’s 500 biggest corporations.

Debuting at the 498th rank in 2006 with US$ 13.755B in revenues, SBI has nearly trebled in size to US$ 36.95B since then to reach its current position where it’s bigger than Goldman Sachs (US$ 36.793B), Commerzbank (US$ 29.235B), Standard Chartered Bank (US$ 24.488B), and many other better known banking giants.

However, with assets of “only” US$ 360B, SBI is smaller than the smallest bank on this list (China Merchant’s Bank, revenues US$ 22.093B, assets US$ 445B).

To recap, SBI has a high rank by revenues but low rank by assets.

This disconnect suggests that SBI turns over its assets at a greater rate than other banks. In other words, SBI should have a higher Revenues / Assets ratio compared to other banks.

To verify this, I decided to check out the industry-wise list on the magazine. But, unlike in past, there was no such list in the print edition or website of Fortune Global 500.

Therefore, I developed one myself. You can download it from here.

It turns out that my guess is spot on. SBI ranks #7 on the Revenues / Assets metric as against #33 on revenues and # 45 on assets.

While I’m no financial analyst, I’m guessing that SBI’s superior performance on Revenue:Asset ratio can be explained by the relatively high Net Interest Margins prevailing in the Indian banking industry.

For the uninitiated, Net Interest Margin (NIM) is “a measure of the difference between the interest income generated by banks (from loans given to borrowers) … and the amount of interest paid out to their lenders (on deposits received from depositors), relative to the amount of their (interest-earning) assets”.

NIM for local and multinational banks in India hovers in the 350 to 500 bps range.

During SBI’s five year reign as a FORTUNE 500 company, no other Indian bank has entered the FORTUNE GLOBAL 500 list. A comparison of the revenues of India’s second largest bank, ICICI BANK, (US$ 13.812B) with that of the last company in the list (MANPOWER @ US$ 22.006B), suggests that SBI might have a solitary reign on the list for the forseeable future.

However, given the relative buoyancy of the Indian economy, I won’t rule out the possibility that some other bank could become a FORTUNE 500 company sooner rather than later, especially if the industry’s high NIM levels hold up in the coming years. Let’s see…

Full Disclosure: Apart from my present or past banking relationships with some of the banks mentioned in this blog post, I have no other interest in them.

* The print version of the magazine calls it RANK 2011 but, to see this list online, select 2012 – not 2011 – from the dropdown menu on the website.

UPDATE DATED 20 JULY 2020:

It’s seven years since the above post was published. No other Indian bank has entered the FORTUNE GLOBAL 500. All eyes are on HDFC Bank, which has zoomed past ICICI Bank to become the second largest bank in India, with revenues of close to US$ 20 billion for the latest fiscal year ended 31 March 2020.