At the end of my blog post entitled AXA Fizzy – The New Kid On The Blockchain, I’d promised to answer the “Why Blockchain?” question in a follow-on post.

I’m not fulfilling that promise yet.

Frequent readers of this blog would be aware that it’s light on research and heavy on personal experience and anecdotal evidence.

For reasons highlighted in my previous post, I couldn’t – and still can’t – buy an AXA Fizzy insurance policy. Nor could I find anyone else who has bought one. Without personal experience or anecdotal evidence, I found it hard to deep-dive into the “Why Blockchain?” subject. Since writing a post entirely on the basis of desktop research is not my style, I was about to can my follow-on post.

Until I found another Blockchain flight delay insurance product that I could “test drive” a couple of weeks ago.

This is from an unnamed company whose website features a origami bird as its logo but lacks any other branding. According to the fineprint on the homepage, it’s powered by one etherisc.com, whose website says it’s a provider of “decentralized insurance”.

I’d actually stumbled onto this website soon after I heard about AXA Fizzy. At the time, it allowed purchase of flight delay insurance on many sectors, including BOM and DEL airports in India – unlike AXA Fizzy, which offers policies only on flights to and from CDG. However, it accepted only ETH payments.

EtherIsc offers "Flight Delay Insurance" on more sectors than AXA Fizzy – but requires alt-coin payment. https://t.co/G4VQjzHVLq pic.twitter.com/tkchBAz4uj

— GTM360 (@GTM360) October 6, 2017

On my next visit to this website, only to find that it now offered policies only on flights in and out of SFO. So, once again, I couldn’t buy insurance on a sector originating from BOM or DEL in India.

But on this visit, I saw an addition to the fineprint: The website said its policies were issued by one Atlas Insurance PCC Limited, an insurance company based out of Malta. Absent any brand name on the website, I’ll refer to this product / company as “Atlas Etherisc” going forward.

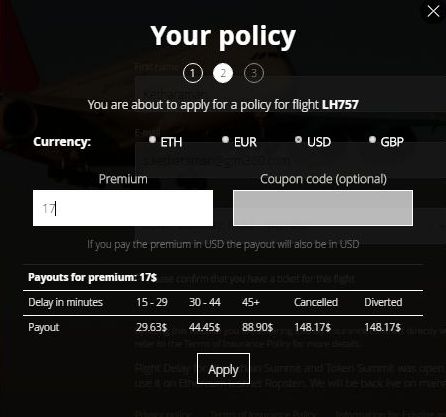

A few days after publishing AXA Fizzy – The New Kid On The Blockchain, I happened to visit Atlas Etherisc’s website again. This time, it offered insurance on BOM / DEL sectors and accepted fiat currency payments in USD / EUR / GBP. I decided to apply for a policy for the BOM-FRA sector on Lufthansa LH757 flight. The premium and payouts are shown in Exhibit 1.

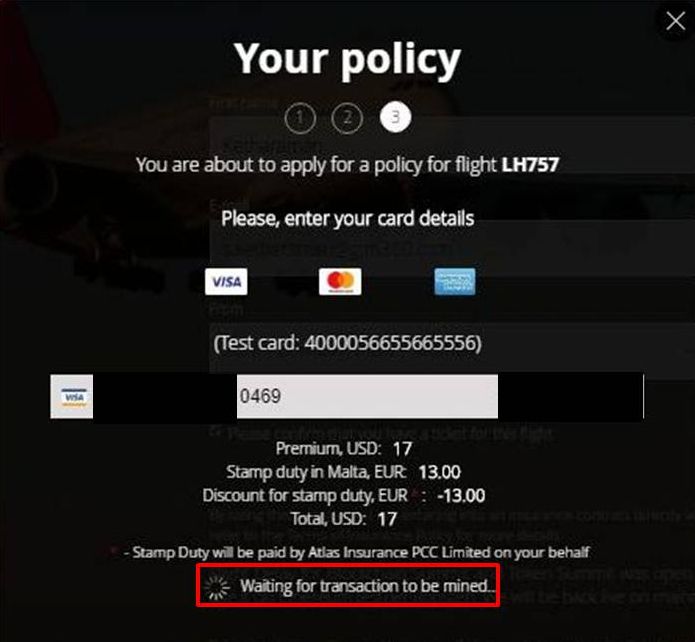

When I entered my credit card details to make the US$ 17 payment and hit the “Apply” button, the website went into a tizzy and displayed a message saying “Waiting for transaction to be mined” (see Exhibit 2).

I guess that was the process of writing the transaction on the Blockchain.

This message was still there after five hours. (Now I get why system architects recommend centralized database if performance is key.)

I don’t know whether Atlas issued a policy in my name or successfully registered the transaction on the Blockchain.

I now have personal experience of an insurance dApp. I hope to get some anecdotal evidence about dApps in the coming days. In the meanwhile, I also gained some more experience on a conventional insurance website.

Thanks to all this, I feel adequately geared up to deep dive into the “centralized versus decentralized app” subject and finally fulfill my promise to write that elusive follow-on post on the “Why Blockchain?” question. (Spoiler Alert: We’ll see another example of Hiding Your Secret Sauce.)

Stay tuned!