Take the following thread on Twitter.

@s_ketharaman: Merchant A/c is reqd. for BharatQR, I wonder how many such merchants will qualify for it. Meanwhile, PayTM will race ahead:)

@logic: After Banks figure this out and do something with eKYC, they will realize that people are not ready to pay MDR, want privacy

@s_ketharaman: But Merchants pay MDR, not Consumers!

@logic: nice dream.

Twitter user @logic was implying that merchants will definitely pass on the MDR cost to consumers.

In short, he was confusing MDR for Surcharge.

While both amount to a charge on card payments, they’re not the same.

By definition, MDR is borne by a Merchant whereas Surcharge is paid by a Cardholder.

Before I describe the differences between MDR and Surcharge, here’s a quick overview of the payment card value chain.

PAYMENT CARD VALUE CHAIN

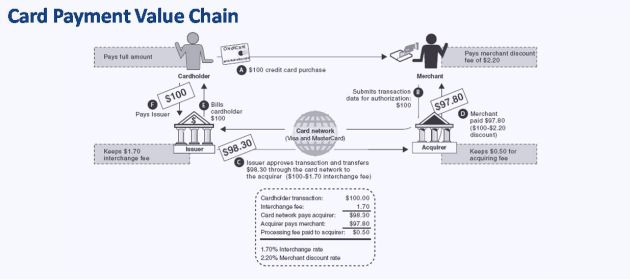

The key entities in the so-called “card payment value chain” that processes a card payment are as follows:

Cardholder: The consumer that uses a credit or debit card to buy something e.g. John Doe, Jane Doe

Merchant: The business that sells that “something” to the Consumer and receives payment via payment card e.g. ASDA, Big Bazaar

Issuer: The bank that issues the card to the Consumer e.g. Barclays, State Bank of India

Acquirer: The bank that issues a Merchant Account and POS (or POS alternatives like Bharat QR) to the Merchant, both of which are required for the Merchant to accept card payments e.g. Citi, HDFC Bank

Card Network: The company that owns and operates the infrastructure – aka “rails” – for processing card payments e.g. Visa, MasterCard.

Others: PSP (Payments Solutions Provider) who processes card payments on behalf of Issuer and Acquirer; ISO (Independent Sales Organization) who sells Merchant Accounts on behalf of Acquirer; MA (Merchant Aggregator) who signs up a Merchant Account in its name from Acquirer and then parcels it out to end Merchants who may not qualify for Merchant Accounts in their own name from the Acquirer (e.g. SQUARE for instore card payments, Stripe and PayPal for online card payments) et al.

The card payment value chain is also called a “4-corner marketplace”. Created over 50 years ago, it enjoys the so-called “network effect”, which explains its enduring popularity. The Merchant incurs a cost for using this infrastructure to accept card payments. This cost is called MDR or Merchant Discount Rate.

With the basics of card payment out out of the way, let me come back to the key differences between MDR and Surcharge:

- MDR is the fee incurred by the Merchant for accepting card payments. Any charge levied by the Merchant on a consumer paying by card (over and above the price of the product or service purchased by the Cardholder) is called Surcharge. As we’ll see shortly, Surcharge need not equal MDR (and often does not)

- Set by the Card Network, the schedule of MDRs forms a part of the Merchant Account signed between the Merchant and the Acquirer. As a consequence, MDR is pre-defined, strictly regulated and ranges from 0.5-3% depending upon the product purchased and the type of card used for payment. (For the sake of convenience, I’ll assume a uniform MDR rate of 2% for the rest of this post.) On the other hand, Surcharge is totally arbitrary – it’s whatever the Merchant says it is. I’ve come across Surcharges ranging from 2 to 10%. In other words, Merchants slap Surcharge – masked as ‘Convenience Charges’ – that’s as high as 5X of the MDR cost they incur

- MDR is deductive. That is, if the sale value at the till is £100, the acquirer retains £2 and passes on £98 to the Merchant. On the other hand, Surcharge is additive. That is, against the purchase value of £100, the consumer incurs a cost of £102 at checkout (going by 2% MDR considered in this post)

- Being deductive, MDR attracts no taxes. Whereas, being additive, Surcharge attracts taxes. So, the total charge seen by the Cardholder on their statement is even higher than £102

- In return for MDR, a Merchant gets many freebies from the Acquirer e.g. fire insurance for store. Cardholder gets nothing for shelling out Surcharge.

INR 570 "Internet Handling Fees" for tickets costing INR 7500? Well tried @BookMyShow pic.twitter.com/RtmHfWJbIc

— GTM360 (@GTM360) July 28, 2015

In case all this sounds a bit technical, that’s because it is. But I’m still going on about it because it shapes the Average Joe / Jane Consumer’s payment mode preference.

I’ve made no secret of my disdain for Surcharge. According to me, MDR is the Merchant’s cost of doing business. By not accepting credit cards, merchants can lose business. Like rent, electricity, employee and other costs, Merchants have to recover their card processing fees from their sales – they can’t pass it on explicitly. If a Merchant still insists on a Surcharge, I can walk out and buy the same thing somewhere else without paying Surcharge.

Armed with this knowledge, I flatly refuse to pay Surcharge for paying with my credit card.

When Merchants try to justify Surcharge on the grounds that they have to pay a fee to banks, I politely remind them a few things:

- I pay annual fees to the Issuer for my credit card. Will you reimburse me those fees?

- You get fire insurance for signing up a Merchant Agreement and incurring MDR. What will you give me extra if I pay you Surcharge?

- If I pay for something with a credit card today, the Issuer pays you after a day or two. Suppose I abscond when I get the bill from the Issuer after 30 days, you don’t refund what you collected from the Issuer before.

In short, I emphasize that the credit card model DOES NOT WORK on a back-to-back basis.

Whether they get the jargon or not, most Merchants get the message when they hear this, and quietly give up their demand for Surcharge. Mission accomplished!

As for the pig-headed minority, they lose my business: I simply dump the goods on the checkout counter and walk out.

To be sure, this tactic only works when there’s a human being on the other side to listen to my discourse.

If a website demands Surcharge, I abandon my shopping cart and rant about it on Twitter.

Old news. LIC & MSEB still levy surcharge on credit card payments. Talk is cheap. It's time for action! pic.twitter.com/8CQDOAowaY

— Ketharaman Swaminathan (@s_ketharaman) September 8, 2016

Somtimes it works!

I know you “can’t win ’em all” but that shouldn’t stop you from trying!

Most people don’t want to incur an extra cost for using their cards. They stick to cash if a merchant levies a surcharge. This crimps the wider adoption of digital payments.

This post should give those people enough ammunition to rebut Merchants’ demand for Surcharge and accordingly switch to card, thereby taking #CashlessIndia to the next level.