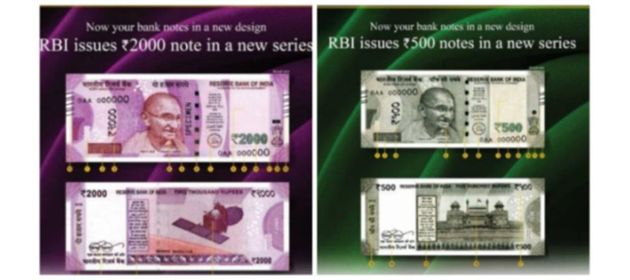

The Indian government recently demonetized the INR 500 and 1000 notes and announced plans to introduce new design notes in INR 500, 1000 and 2000 denomination.

In the wake of this move – trending on Twitter as #CurrencySwitch among other hashtags – many people have been asking why India hasn’t taken this opportunity to go totally cashless.

Many Indians have been replying with statements like “Indians are illiterate” and “Indians are not tech savvy”.

This is a Public Service Announcement to Indians to stop going on the defensive on this subject.

Not just because literacy levels in India have improved considerably in recent times or because Indians are far more willing to try out new technologies.

But because going cashless is less about literacy or tech-savviness and more about hurdles related to business model and consumer behavior. Obstacles include high MDR cost, friction of making cashless payments, aversion to being tracked, fear of overspending, reluctance of banks to issue merchant accounts, and so on.

I’ve blogged about these challenges on this blog and Finextra over the past few years. Here’s a quick recap, updated with recent developments following the announcement of #CurrencySwitch on 8 November 2016.

#1. High MDR Cost

“Merchant Discount Rate” or MDR refers to the fees paid by merchants for being able to accept cashless payments.

For credit cards, which are the most popular form of cashless payments in India, MDR is around 2%. For many categories of merchants, this is a prohibitively high cost e.g. khirana stores (India’s equivalent of mom-and-pop grocery stores) who operate at around 5% gross margin.

There are other forms of cashless payments such as mobile wallets, prepaid cards, and so on. While they may charge lower fees, they come with their own challenges related to friction, speed, concerns around shareholding pattern, etc.

Forfeit INR 50 Cashback vs. Keep my credit card on file w/ a virtually-Chinese company PayTM. Choice is clear. #CurrencySwitch pic.twitter.com/rgAhUk7hrx

— GTM360 (@GTM360) November 14, 2016

#2. Friction

Online card payments are subject to two-factor authentication. While 2FA has the noble intent of making payments more secure, it causes friction and leads to failed payments.

Offline – or instore – payments are subject to PIN. While friction in offline payments has reduced since the Chip+PIN regime was introduced last year, hooded POS terminals are few and far between. As a result, there’s no privacy while entering PIN.

Online or offline, even tech-savvy people have gone from card to COD payments.

#3. Aversion To Being Tracked

Every cashless payment involves a third-party apart from the consumer and merchant. This means every purchase made with a cashless method of payment is being tracked.

Even if people have nothing to hide, they tend to get put off by spam when their purchase information – what, where, how much for did they buy – falls in the wrong hands.

#4. Fear of Overspending

Cash is tangible whereas cashless MOPs are intangible. It is widely perceived that credit / debits can lead to overspending. As Santosh Desai points out in Times of India,

It is easier… to spend money using a credit card, for the outflow seems more theoretical than it does when paying in cash. The difference between Rs 2,000 and Rs 20,000 is a slip of the pen in one case and a complex exercise involving withdrawing money from the bank, carrying it in one’s wallet and counting it (twice) before handing it over.

Overspending is not a concern in my 25+ years of using credit cards because I maintain a meticulous record of all charges I put on my credit card. However, that’s only me and I can appreciate why most people do believe card payments can lead to overspending.

Brilliant article by @desaisantosh on the philosophy, psychology & reality of cash v. cashless payments – via @timesofindia pic.twitter.com/Kr598ilVBH

— GTM360 (@GTM360) November 14, 2016

#5. Reluctance of Banks to Issue Merchant Accounts

To accept card payments, merchants ostensibly need a POS terminal, telephone connection and a basic knowledge of operating the PIN keypad. Most merchants I come across can handle all this.

But these are not enough. One major prerequisite of accepting card payments is a Merchant Account. For the uninitiated, this is a contract between a bank (“acquiring bank”) and a merchant. Because their risk management norms are conservative, banks have traditionally shied away from issuing merchant accounts to khirana stores, vegetable vendors, cabbies and other so-called “micro merchants” that are considered high risk. As a result, many merchants from whom consumers make everyday purchases are unable to accept card payments even if they wish to.

Going by post-#CurrencySwitch announcements from State Bank of India, India’s largest bank, this may change going forward but it’s still early days.

IMO, this is the biggest stimulus for cashless payments since #CurrencySwitch was announced.https://t.co/vlRRHTuWlN

— GTM360 (@GTM360) November 16, 2016

#6. Cash-Out Costs

Because of #5 above, taxi drivers are unable to accept card payments on their own. They do accept card-linked mobile wallet payments via their aggregator company e.g. Uber, Ola.

If you thought this would push one big everyday expense category to cashless payment modes, you’d be mistaken.

Cab drivers are still reluctant to accept cashless payments since they entail heavy Cash-Out costs and delays. As a cabbie once told me:

When customers pay by cash, I get the money immediately. However, when they pay by card, the money goes to the aggregator. It takes me anywhere from a week to a fortnight and a couple of fareless trips to the aggregator’s office to collect it. So, accepting electronic payments is not good for my business.

This problem has only gotten exacerbated since #CurrencySwitch:

2 @Uber_India drivers askd me2 cancl trips coz they wanted currencies2 fill diesel. Cash trips hv dropped, so no money 2 fillup. #CashRush

— **Gopinath** (@gopibella) November 13, 2016

#7. Card on Delivery Limitations

Because of friction in online payments, I’d gone back to Cash on Delivery for online shopping.

Then Amazon India and a couple of other ecommerce companies started offering Card on Delivery. With this payment mode, I can avoid paying online but still pay with my credit card when the consignment is delivered.

I’d rate this as the most convenient method of payment for online shopping. It also saves the ecommerce company a load of trouble of handling cash. Given these two benefits, I’ve been expecting this win-win MOP to go mainstream. But that hasn’t happened.

I learned why from this post-#CurrencySwitch article on Economic Times:

TIL why some ecommerce co.s are not offering Card on Delivery: Their 3PLs don’t want to run risk of being "Merchant on Record".

— GTM360 (@GTM360) November 16, 2016

Therefore, ecommerce companies that outsource deliveries to third-party logistics firms can’t offer Card on Delivery.

To paraphrase Hamlet, there are more things that come in the way of going cashless than are taught in an engineering college.

To paraphrase Hamlet, there are more things that come in the way of going cashless than are taught in an engineering college.

India is not alone.

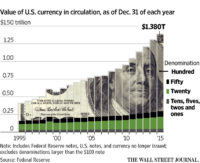

No country has gone cashless. 85% of world’s transactions happen in cash according to Business Insider. Currency in circulation in USA has actually risen according to The Wall Street Journal.

So let’s not beat ourselves up for not going cashless. For a cashless – or even less-cash – regime to happen, many more things need to fall in place than just literacy and tech-savviness. My post How To Really Kill Cash provides a few pointers.

Jai Hind!