The unthinkable has happened – the entry barrier of the FORTUNE GLOBAL 500 list has actually come down.

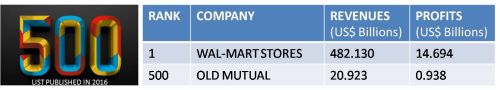

Yes, the last company in the latest FORTUNE GLOBAL 500 list (published in Fortune magazine dated 1 August 2016) posted a revenue of US$ 20.923 billion compared to US$ 23.720 billion turned in by its counterpart last year. Expressed as a percentage, the “qualifying revenue” to become a GLOBAL 500 company has dropped by 11.79%.

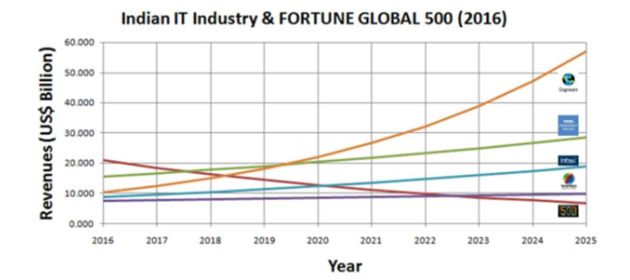

This changes my rolling forecast of the year of entry of Indian IT companies into the hallowed list of the world’s 500 largest corporations.

But before I deep dive into the Indian IT industry, here are a few facts and figures about this year’s list.

- WAL-MART STORES (USA) ranks #1 and OLD MUTUAL (UK) ranks #500, with the following financials:

- Fortune has reinstated the GLOBAL 500 story to its cover. Regardless of whether this happened in response to my last year’s rant or otherwise, I’m happy to see the feature restored to its former glory.

- Total sales for the Global 500 fell 11.5% from US$ 31.212 trillion in 2015 to US$27.634 trillion in 2016. Fortune attributes this drop chiefly to a “historic surge in the value of the greenback” against major currencies during the reporting period i.e. fall in major currencies against USD. For the uninitiated, since they’re based all over the world, companies in FORTUNE GLOBAL 500 earn revenues in different currencies; but, to be reckoned for this list, their revenues must be converted and expressed in USD regardless of their domicile. For example, a company HQ’d in India might have grown its revenues by 8% in its native currency INR. But, because INR fell 10% against USD, FORTUNE GLOBAL 500 would report that the company’s revenues shrank by 2%. This sounds a bit unfair but no one stopped a non-American publisher from compiling and popularizing a competing list denominated in GBP or EUR or whatever.

- Bangalore, the Silicon Valley of India, enters the list. But, ironically, not via an IT company.

Bangalore enters FORTUNE GLOBAL 500 via @rajesh_exports . pic.twitter.com/5IMYURfK5I

— GTM360 (@GTM360) August 19, 2016

Now coming to the Indian IT industry.

Last year I’d revised my model in response to the flat line revenues posted by the last qualifying company. This year, I’ve reworked it to account for the decline of 11.79% in the qualifying revenue. This is the result:

(Click here to download the Excel model).

Based on the revised figures:

- TCS will enter the GLOBAL 500 in 2018. Despite its sales growth rate halving (7.06%) from last year (14.97%), the drastic fall in the qualifying revenue has expedited the company’s entry into the list

- COGNIZANT will also join the GLOBAL 500 in 2018. But its earlier entry is as much driven by its faster-than-predicted sales growth (20.99% actuals versus 16.05% forecasted) as the fall in the list’s entry level revenue

- Thanks entirely to the lowering of the bar, both INFOSYS (2020) and WIPRO (2023) will enter the GLOBAL 500 within the model’s lifespan.

The above predictions assume that (a) all companies maintain their current CAGR into the future and (b) that the qualifying revenue to enter the list will also follow its present trajectory i.e. it will fall by 11.79% y-o-y.

Going by the recent guidance issued by many leading IT companies, the first assumption might seem a bit ambitious – but only if we presupposed growth solely via organic means. It’s possible that some of these companies might deploy their huge cash reserves to make a few big-ticket acquisitions. That would tilt the scales as many of them would grow faster than their current CAGR and enter the GLOBAL 500 even earlier than predicted.

The second assumption can be challenged on at least two grounds:

- Dollar appreciation could be a one-time event.

- Because they earn in USD, American companies’ revenues won’t come down due to USD appreciation. Therefore, they will overtake foreign corporations whose revenues will keep shrinking in USD terms. Therefore, we should backstop the list at the revenue of the last US company on the present list. This is US$ 21.059B of STAPLES @ Rank #497.

On the face of it, both arguments are powerful.

But, with the USD gaining even further ground since Brexit, which happened after the list was published, dollar appreciation is clearly not a one-time aberration.

But, with the USD gaining even further ground since Brexit, which happened after the list was published, dollar appreciation is clearly not a one-time aberration.

Besides, as Fortune points out in How a Spike in the Value of the Dollar Is Hurting the U.S. Economy, “the greenback’s large, sudden appreciation is proving to be a major drag on the U.S economy … and inflict a big hit on growth”. So, it’s quite probable that revenues of American companies would drop if the dollar continues to rise. So, there’s no guarantee that STAPLES – or any other US company – can qualify to be the GLOBAL 500 list’s gatekeeper.

Therefore, I’ve gone ahead with the second assumption for now, with the following caveats:

- Continued application of the assumption would result in a billion dollar company eventually entering the GLOBAL 500 list. Greek syllogists would call this Reductio Ad-Absurdum. I’d call this irrelevant – we’ll stop caring about this list long before this happens.

- I should revisit this assumption every year.

In conclusion, if the GLOBAL 500 hurdle revenue keeps falling, one or more of the featured Indian IT companies will become Fortune GLOBAL 500 corporations sooner rather than later. If the qualifying revenue falls next year, I’ll take that as a prompt to expand my model to include the industry’s next ranked companies, who would then stand a fair chance of becoming a Fortune GLOBAL 500 company with the model’s lifespan. But all this is true only as long as the Indian IT industry remains largely export-oriented and continues to earn at least 70% of its revenues in USD. If that changes, the industry’s entry into GLOBAL 500 will prove more elusive than ever before.