My property management company in UK wanted me to quote the following reference along with my monthly rent payment:

My property management company in UK wanted me to quote the following reference along with my monthly rent payment:

MCS MERIDIAN CLIENT ACCOUNT HOUSE RENT 98 MERIDIAN PLACE JUN 2008

The reference field in the fund transfer screen of my bank’s Online Banking was too short to support this narration. While I could’ve written it easily on the back of a cheque, the maximum reference I could squeeze into my screen was MCS MERIDIAN CLI.

As a payments professional, I knew that inadequate remittance info would make it tricky for the beneficiary to apply incoming payments to the right customer, and thereby increase the risk of the payment falling into a “cyberabyss” from where it’s very painful to repair. Therefore, I refrained from paying my rent electronically. Click here for more details.

I’ve encountered similar situations many times through the following years in India. Ergo, I’ve shied away from account-to-account electronic fund transfer (A2A EFT) methods like NEFT.

It’s not only me.

I recently came across many individuals and businesses who have developed cold feet towards digital payments.

#1. ISP BILL PAYMENT

A company I know always paid its ISP’s bills on time via NEFT but found its Internet connection getting disconnected frequently for non payment of bills. Because I know a bit about the inner workings of payment networks, the COO of this company sought my help to figure out what was happening. This is what I found out:

The ISP requires its customers to include the Customer Number and Bill Number along with their NEFT payments so that it can match collections against specific invoices. The said Company couldn’t fit this info in the reference field of its NEFT transfer form. Thinking “What can go wrong?”, the company left the field blank and still went ahead and made the payment with NEFT.

Big mistake.

Since there was no info in the receipt to link it to the company, the payment fell headlong into a cyberabyss at the ISP’s end. According to the ISP’s accounts receivable system, the bill was outstanding. Ergo the ISP disconnected the company’s Internet connection.

It took a lot of back-and-forth interactions between the company and the ISP to resolve the mess.

These days, this company pays its bills strictly by cheque. It can write all the “remittance info” required by the ISP on the reverse of the cheque. Ever since it made the switch, it hasn’t suffered disconnection of its Internet connection.

#2. IIT BOMBAY EVENT FEES

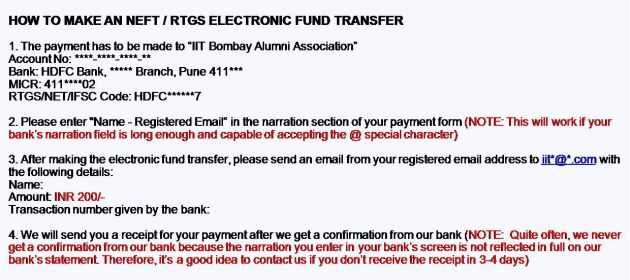

My alma mater’s alumni association recently conducted a short event for which it charged a token fees of INR 200 (~US$2.5). It accepted payment via cheque and NEFT.

In the past, the limited amount of info accompanying NEFT payments had caused it huge amount of reconciliation problems.

Therefore, this time, it went out of the way to devise a comprehensive procedure to ensure that all NEFT receipts could be traced back to the appropriate source and given due credit. While you can find the full details of the procedure in the following exhibit, suffice to say that the journey required the alum to jump through several hoops across website, email and telephone.

While the attendees were appreciative of the efforts taken by the alumni association to rectify what was essentially a lacuna in the EFT rails, an overwhelming majority of them simply wrote cheques.

End of problem.

Will you jump through all these hoops to make an electronic fund transfer or simply write a cheque? https://t.co/XFVDmDBfsZ

— Ketharaman Swaminathan (@s_ketharaman) March 14, 2016

#3. DIRECT CREDIT

In the past, I used to get dividends, income tax refunds, insurance payouts and other payments by cheques. They’d always be accompanied by a statement providing details of the company, scrip, product, period, contact info in the event of discrepancies, etc.

Nowadays, these payments hit my bank account directly. Let alone the above detailed information, I can’t even identify of the payer from the cryptic narration that accompanies these payments e.g. “ACH C- IOC REF NO3000089966-509038878490”.

Now, if you’re like a lot of people I know, you might not care where you get money from, just that you get it. The “don’t look the gift horse in the mouth” is good practice in general but it can lead to a few serious problems when it comes to payments:

- You can be implicated in a crime if the source of the money is not kosher, even if the money entered your account without your knowledge or approval

- How will you report these receipts in your tax returns?

- If the money does not belong to you, it’s a crime not to report it to your bank, even if somebody else deposited it into your account.

As the above examples show, inadequate remittance info has stunted the growth of EFT for sending and receiving retail payments.

Hopefully, there’s light at the end of the tunnel.

According to this report, UK is seriously considering a decree to mandate longer remittance fields for electronic payments. Hope other countries follow suit. It’s a no-brainer that enhanced remittance info will go a long way towards driving up EFT volumes.

UPDATE DATED 1 MAY 2017:

In prescribing longer remittance fields as a panacea for EFT reconciliation challenges, I’ve made the tacit assumption that the receiver will see the same narration that’s written by the sender of the payment. Today I learned from a friend that I could be wrong. Apparently, receivers don’t.

After reading his comment on my Facebook update, I immediately realized where my assumption could go wrong:

The narration seen by the receiver is shaped not only by the system used by the sender bank but also by the systems used by the receiver bank and the scheme operator (which, in the case of NEFT, is RBI). AFAIK, there’s no guarantee that these three disparate systems will handle the content of the narration field in the same way. In fact, I’m reasonably sure they won’t, going by the example of a bank that uses a non-uniform practice for narration fields for two different payment schemes within itself!

Mystery: Why does @HDFC_Bank allow longer narration for IMPS compared to NEFT payments? pic.twitter.com/eAoSIHsGeZ

— Ketharaman Swaminathan (@s_ketharaman) May 2, 2017

Given the multiple systems involved in fulfilling an end-to-end EFT payment, it’s very likely that the receiver doesn’t see the narration entered by the sender. And, according to anecdotal evidence, that’s indeed the case: My aforementioned friend reports that he can see the sender’s details when he receives an NEFT payment but not when he receives an IMPS payment. This makes EFT reconciliation even trickier than I’d imagined. Sigh.

UPDATE DATED 4 JUNE 2018:

I made an IMPS payment from my company’s account today. The Merchant was kind enough to show me their statement of account for this receipt. The entry didn’t have my company name, my name or the narration entered by me on my bank’s IMPS screen. The only personally identifiable information in the entry was my personal mobile phone number. I happened to notify the merchant’s CEO of my payment in parallel via email. Without my heads-up, they wouldn’t have been able to reconcile it with their invoice.

"Per new survey, corporates clamor for enriched data rather than faster payments".

Why don't they conduct such surveys BEFORE accelerating "Faster Payments" and decelerating "Enhanced Data" projects?https://t.co/RbYsnzZXVm— S.Ketharaman (@s_ketharaman) May 18, 2018