Since I wrote HDFC Bank’s PayZapp Ends My Bill Payment Woes, I’ve made a few more bill payments using the mobile wallet. All of them went through successfully (knock on wood!).

I’m even more convinced that PayZapp is the best way of paying bills for people who’ve tried out other alternatives.

That said, PayZapp faces many challenges in appealing to Millennials and other first time users who tend to assign fairly different weightages to the security-trust-convenience elements of the bill pay trifecta compared to power users.

That said, PayZapp faces many challenges in appealing to Millennials and other first time users who tend to assign fairly different weightages to the security-trust-convenience elements of the bill pay trifecta compared to power users.

Security

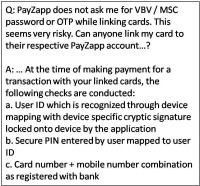

When first time users notice that there’s no need to enter CVV, VbV / MSC or OTP to complete a PayZapp payment, they might get a culture shock. Such a smooth experience might be par for the course for power users – no US website I’ve used has asked for VbV / MSC or OTP and some have even skipped the CVV entry step – but first time users might bail out when they encounter an entirely “passwordless” process.

Trust

On the face of it, first time users might find MobiKwik, M-PESA, PayTM and any one of half a dozen other providers of third-party mobile wallets to be as compelling as PayZapp. They might not readily appreciate the risk of loading money into a non-insured third-party prepaid wallet or realize that there’s a difference in paying a utility bill on the utility’s website versus paying it through a third party like a bank, fintech or MNO.

Convenience

The mainstream American culture dismisses techies as socially awkward / geeks / nerds.

Difference between Mainstream American Culture and mainstream cultures in many other countries towards techies – in one tweet.#geek #nerd #india https://t.co/1coW4Vfxsm

— GTM360 (@GTM360) July 7, 2021

According to legend, Mark Zuckerberg created Facebook while he was at Harvard to help techies score dates in US college campuses.

The situation is exactly the opposite in India.

Tech savviness is a badge of honor worn proudly by people of all generations. Maybe because IT won a place for India on the global stage or whatever, anything to do with tech is considered cool in the country. If a mobile app crashes while trying to discover a user’s location automatically, the user will figure out how to force stop it, re-open the app and enter the location manually. And go and boast about how he made the app work to his friends. Even girlfriends! Frictionless operation, a key strength of PayZapp, is not a very effective hook to win new customers.

It’s clear that Millennials view bill payment solutions in a different light compared to power users. It’s against this backdrop that HDFC Bank must find ways of enhancing the appeal of PayZapp to them.

This is not easy. Let me explain the challenge by taking security, the first element of the bill pay trifecta.

Since I was familiar with Apple Pay Provisioning Fraud, the first thing that struck me when I onboarded PayZapp was, what stopped a fraudster from creating a PayZapp account with my credit card information and going on a shopping spree at my cost?

In its FAQ, PayZapp rules out the possibility of provisioning fraud. While I wouldn’t claim that I fully understood the bank’s explanation, I felt comforted that HDFC Bank had raised this question upfront instead of pointing fingers at users and / or merchants if and when such a fraud were to happen later.

But that’s only me.

It’s highly questionable how many first time users would take the trouble to download a PDF, understand the finer points of the bank’s cryptic assurance that PayZapp is not susceptible to provisioning fraud and go ahead with adding their card, especially debit card, to PayZapp (Despite my comfort feeling, I didn’t dare link my debit card). When power users refuse to link their debit cards to PayZapp, it’s not a big deal since they can link their credit cards, which is what I did.

However, many Millennials and first time users do not have credit cards – there are only 20M credit cards in India as against 500M debit cards. If people don’t feel comfortable linking their only card – debit card – to PayZapp, that will deal a severe blow to PayZapp’s customer acquisition plans.

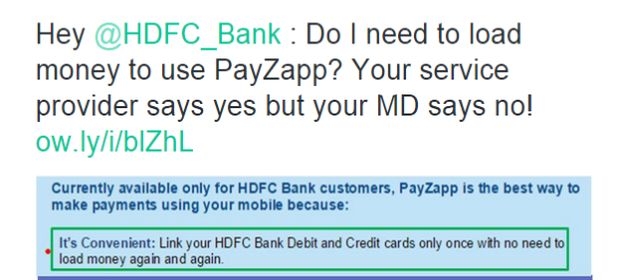

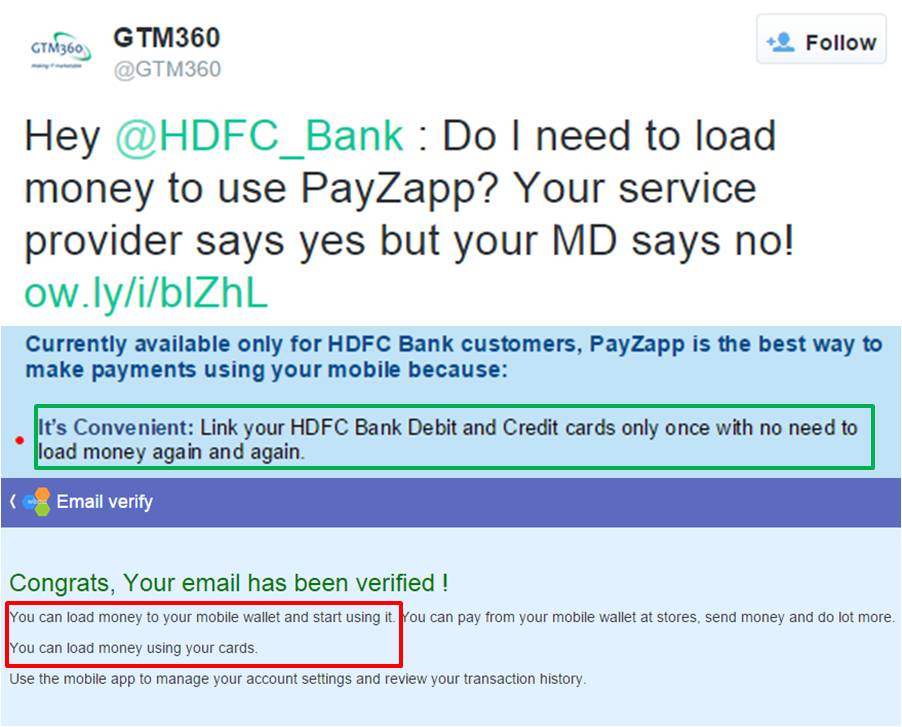

Moving on to the trust and convenience elements of the bill pay trifecta, PayZapp has strong differentiators compared to other payment apps such as no need for loading money, low-risk bank-direct model of bill payment, highly frictionless experience, and so on. However, it’d be wishful thinking to assume that first time users would appreciate them readily.

HDFC Bank needs to make concerted efforts to articulate the strengths of PayZapp in the context of the security, trust and convenience considerations of first time users. How well it does that will determine PayZapp’s success in winning Millennials over. A good starting point would be to prevent confusing messaging around key USPs like the one shown in the exhibit on the left.