I get around 15 bills a month from telcos, utilities and other types of billers. Being an omnichannel freak, I don’t have any bias towards where I pay them, with my choice of payment channel depending largely upon where I am when a certain bill falls due: If I’m close to my laptop, I pay at the biller’s website; if I’m in the biller’s neighborhood, I pop in to its office and pay at its counter. I’m a user of what bill pay insiders would call the “Biller-Direct” option of bill payment.

I’m also a big fan of rewards, deferred payment and enhanced fraud protection offered by credit cards. No other payment mode – debit cards, electronic fund transfers, cash or cheques – match these benefits of credit card. So, when it comes to the payment instrument, credit card wins hands down – whether I pay online or offline.

Of late, credit card payments have become very painful in India. While I’ve blogged about this subject many times, here’s a quick recap:

With a regulatory framework that doesn’t seem to care about throwing the payment baby out with the fraud bathwater, there’s a lot of friction in both online and offline card payments in India.

Online payments follow a very circuitous route and inevitably time out midway, leading to failed payments.

OMG, the actual success rate of online payments is only 50%. I thought my estimate of 74% was overly pessimistic. http://t.co/50XtElncAO

— GTM360 (@GTM360) May 6, 2014

As regards offline payments, India is perhaps the only country in the world that has implemented not just Chip or Chip + PIN but Chip + PIN + Signature. Many billers who used to accept card payments earlier are no longer able to do so under the PIN regime because their POS machines can’t support PIN or, as is the case with one of my MNOs, they bungled their kiosk migration to PIN.

Loath to forfeiting rewards, I went on a search for alternatives to the Biller-Direct model so that I could continue to pay with my credit card.

I tried Vodafone M-PESA, MobiKwik, PayTM and many other third-party mobile wallets who support the Aggregator-Direct option of bill pay. I’ve blogged about my experience with M-PESA here and will cover the others in a follow on post. Suffice to say that none of them addressed the delicate balance between convenience, security and trust to my fullest satisfaction.

Therefore, I went back to my default biller-direct option. My bill pay woes continued as usual but soon hit a low point recently when three of my online payments failed in a row and two of my billers couldn’t accept credit card at their stores – all in a day’s work. This was when I started yearning for a Cash on Delivery option for bill payment – credit card rewards be damned.

Instead, I got PayZapp.

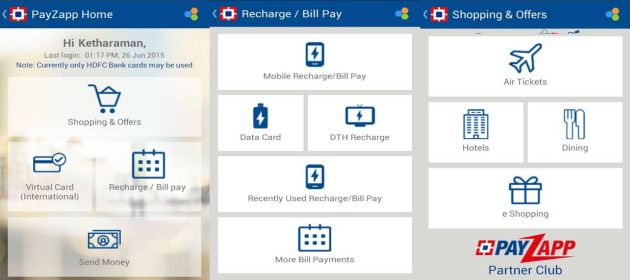

Launched by India’s largest issuer of credit cards – one of which I hold – PayZapp allows users to store HDFC Bank-issued debit and credit cards on their smartphone and make bill payments in one tap.

I downloaded and installed the app. The onboarding process went through smoothly, which was a pleasant surprise given my perpetual crib about how banking applications are rife with friction. To make a payment, you open the app, enter your 6-digit PIN, enter your biller reference number and the amount you wish to pay, tap a button and voila, your payment is done. No need to load money first. No need to enter CVV or VbV or wait endlessly for an OTP. No need to crack complex CAPTCHA codes in between.

PayZapp is a truly-mobile app that leverages the features of a smartphone unlike many other mobile apps that merely work as mobile version of the desktop web. It stores a cryptic device signature on the user’s handset during onboarding. By using this signature to authenticate the payor during each transaction, PayZapp claims to fulfill the regulator’s two factor authentication mandate for card payments without – and I can vouch for that – making him or her jump through a hundred hoops.

From what I could make out when I tried it, PayZapp seems to do all the heavy lifting between the issuer, network, acquirer and merchant systems by itself. Therefore, I’d imagine that the risk of failed payments would be low in the case of PayZapp (Time out faced by the user as their online session is shunted around between the websites of these entities is the primary cause of aforementioned failed payments). This matched my experience – all four payments I initiated on PayZapp this past week sailed through smoothly. Each transaction took barely 10 seconds. And all this happened on the same Internet connection on which three of my payments had bombed in a row during the previous week.

when I tried it, PayZapp seems to do all the heavy lifting between the issuer, network, acquirer and merchant systems by itself. Therefore, I’d imagine that the risk of failed payments would be low in the case of PayZapp (Time out faced by the user as their online session is shunted around between the websites of these entities is the primary cause of aforementioned failed payments). This matched my experience – all four payments I initiated on PayZapp this past week sailed through smoothly. Each transaction took barely 10 seconds. And all this happened on the same Internet connection on which three of my payments had bombed in a row during the previous week.

I know that PayZapp operates in the Bank-Direct model of bill pay rather than my default Biller-Direct model in which I pay the biller directly. In plain English, it means that, when I use PayZapp to pay a bill, I pay HDFC Bank and I need to trust HDFC Bank to send my money to the biller. For reasons I’ll explain in a follow on post, I find that easier to do than trusting a third-party mobile wallet startup to do the same in the case of an aggregator-direct payment.

While it’s still early days, PayZapp has come closest to ending my bill payment woes. Some analysts have called PayZapp a game-changer and India’s Apple Pay moment. I tend to agree with them and predict that PayZapp will gain rapid adoption – but only among power users who have tried other options and found shortcomings with them.

When it comes to first time users and users of third-party mobile wallets, PayZapp faces several hurdles in winning them over. More on that in a follow on post. Watch this space.