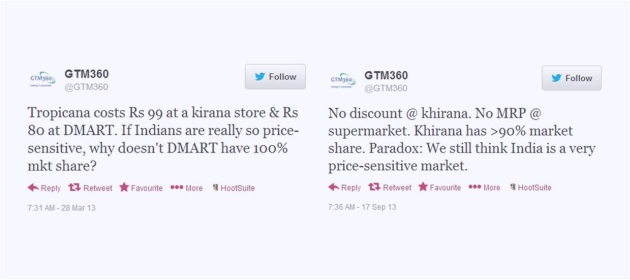

Traditional retailers aka kirana stores sell almost everything at MRP* whereas modern retail aka supermarkets sell almost everything below MRP (for the unintiated, this and other India-specific terms are explained at end of the post).

Since Indians are price-sensitive, modern retail should totally corner the Indian retail market, right?

Wrong!

Modern retail accounts for barely 7% of total retail sales in India. What’s more, it saw a sharp deceleration in growth rate from 32% in 2012 to 5.4% in 2014 unlike kiranas, which grew 7.1% during the same period despite having a manifold higher base (Source: Economic Times).

Strange but true!

Even within modern retail, there’s ample evidence that price is not the sole driver of purchase. Let me take a recent illustration of this.

Even within modern retail, there’s ample evidence that price is not the sole driver of purchase. Let me take a recent illustration of this.

There are two pharmacies in my neighborhood, Wellness Forever* and MedPlus*, that are located opposite to each other. Wellness Forever sells at MRP whereas MedPlus offers a 10% discount on all medicines and 5% on other consumer goods like soap, shampoo, etc. Despite the price difference, both of them have more or less the same amount of crowd.

Day in, day out, there are many signs on the ground that Indian consumers are not just swayed by price but are responsive to offers, home delivery, free credit, mobile app ordering, etc.

But, equally frequently, marketers make a lot of hue-and-cry that Indians only care about price.

This tendency is not restricted to B2C. Let me quote a couple of examples from B2B.

ACCOUNTING FIRM

We were in the process of outsourcing our accounting process, which comprises of several activites from invoicing, payment, storing bills, submission of bank statements and entering the figures into a financial accounting software through to processing of ledgers, preparation of books of account, filing of tax returns and compliance statements.

We received 3-4 proposals from Chartered Accountant* firms.

The one we liked best was from a firm that I’ll call Acme Accounting. While Acme’s price was a bit high, we were impressed by its professional approach and the feedback we received from its reference customers. We asked its Managing Partner if he could do something to “sweeten the deal”. He interpreted this as a request for discount. We explained to them that it was not and told them what kind of deal sweetening would help them win our deal.

Long story short, Acme took on some additional activities that were previously in our scope of work – collection of accounting material from our office, making a photocopy of the entire set, delivering the copy in a file back to us – at no increase in price.

APPOINTMENT-SETTING COMPANY

After completing the offering and content phases of our go to market work for a customer, we wanted to outsource the campaign execution to a third-party. We invited proposals from 3-4 leading appointment-setting companies.

After completing the offering and content phases of our go to market work for a customer, we wanted to outsource the campaign execution to a third-party. We invited proposals from 3-4 leading appointment-setting companies.

After a detailed evaluation, we selected a company that I’ll call Acme Campaigns.

Acme Campaigns offered 16 appointments per month at a price that was way above our budget. Upon hearing our feedback, its sales manager explained the rationale behind the quoted price, which was a good thing, and promised to get back with a discount, which was not a good thing.

Because our customer had a small field sales organization and couldn’t have handled more than 6-8 appointments a month, a discount for 16 appointments a month didn’t help us.

What Acme Campaigns should have done was to offer to reduce its team size and deliver around eight appointments per month at a price that was 30-40% lower than its original price. Such a revised quote would have met our needs and helped us stay within budget (and, as you may have noticed, would resulted in a higher unit sales realization for Acme Campaigns).

Discount means lower price for same scope of work.

Certainly, discount sweetens a deal.

However, going by the above examples, there are many other tactics of sweetening a deal without giving a discount:

- Free home delivery

- Deferred payment viz. free credit, longer repayment period to reduce EMI*

- Lower price for reduced scope

- Higher scope for same price

- Rebalanced scope to reduce the customer’s total outflow.

They all involve restructuring the scope of work and accordingly the price (which is not the same as discounting).

Despite all this, the “Indian customers are price-sensitive” cacaphony doesn’t seem to be receding.

I wonder if it’s because sellers are more obsessed about price than buyers!

*: Given below is a glossary of the many India-specific terms used above.

MRP: Maximum Retail Price. Set by the manufacturer of consumer goods and printed on the product packaging, retailers can’t sell above this price. MRP is a more rigid form of the concept of MSRP (Maximum Suggested Retail Price) that is widely prevalent in other countries.

Khirana: India’s version of mom-and-pop grocery stores.

DMART: India’s “Every Day Low Price” retailer. Other leading big box retailers in India are Big Bazaar, Reliance, Spencers.

Wellness Forever, MedPlus: Pioneers of the pharma retail chain category aka Boots / CVS / Walgreens of India.

Chartered Accountant: CPA of India.

EMI: Equated Monthly Installment i.e. monthly repayment on a loan.