The number of times the words “should” and “charge” appear in this article titled “RBI WANTS TO DISCOURAGE USE OF CHEQUES” got me wondering if “negative reinforcement” is seen as the only way to wean people away from their time-worn habit of using cheques and move them to electronic payments.

The number of times the words “should” and “charge” appear in this article titled “RBI WANTS TO DISCOURAGE USE OF CHEQUES” got me wondering if “negative reinforcement” is seen as the only way to wean people away from their time-worn habit of using cheques and move them to electronic payments.

For the uninitiated, RBI, or Reserve Bank of India, is India’s central bank cum regulator of the Indian banking industry.

The regulator is attempting to ban cheques for multifarious transactions and levy a charge for permitting their use in the others.

Instead of using such negative refinforcement tactics, I wish RBI and the banking industry in India focused their efforts on finding ways to directly stimulate the use of electronic payments. With that approach, I’m sure that they’d accomplish the desired shift from cheque to electronic payments a lot faster and in a manner that is more agreeable with payers and payees, who are the two most important stakeholders in a payment.

The article’s claim that “with electronic payments catching up, cheque usage will come down” is plain and simple delusionary.

Electronic payment won’t grow by accident. Individuals and corporates have been accustomed to using cheques for a long, long time and will switch to electronic payments only if they find a compelling reason to do so. IMHO, the banking industry should step up to the plate and provide that reason(s).

Based on my experience of using cheques and electronic payments in both my personal and professional life for several years, let me suggest the following “positive reinforcements” for bolstering the adoption of electronic payments by retail and corporate banking customers alike:

- BENEFICIARY NAME CONFIRMATION. As soon as the Payer enters the Beneficiary’s Account Number and IFSC / Sort Code on the NEFT / IMPS / RTGS fund transfer screen, the Internet Banking portal should provide a confirmation of the Beneficiary’s name in realtime. This will assure Payers that, when they hit the submit button, their money would reach the right party. Just as people buy from people and not vendor codes, people pay people and not account numbers. Cheques recognize this basic trait of consumer behavior and let cheques to be drawn on the Beneficiary’s name, thus providing Payers with the natural assurance that they’re paying the right party. With Account-to-Account Payments, banks want people to change their behavior by asking them to pay account numbers. On top of that, instead of providing an incentive to ease that change in, banks are doing exactly the opposite by displaying intimidating messages like “Credit will be based solely on the beneficiary account number information; the beneficiary’s name will not be used. We will not be responsible for funds transferred to an unintended recipient”. Not surprisingly, people prefer to cling to the comfort of cheques.

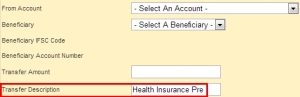

LONG MEMO FIELD. The memo / description field on electronic payment forms should be long enough to accommodate the narration that a Payer would need / like to use in order to clearly communicate the purpose of the payment to the Payee. Take, for example, an individual John Doe who previously made health insurance premium payments by cheque. The insurance company typically asks him to write something like “Health Insurance Premium for FY2012-13 for John Doe & Family” on the reverse of the cheque to help apply the payment to his account. It’s easy for John Doe to follow that instruction when he pays by cheque. Everybody is happy. But, when John Doe goes electronic and tries to enter this narration, his bank will stop him midway. When I tried this on my bank’s NEFT form, I couldn’t get past “Health Insurance Pre” in its transfer description field. Abbreviations recommended by supercillious bankers like this could prove disastrous to Payers. When a policyholder like John Doe truncates narrations, the insurance company receives a payment but doesn’t know from whom or for what. As a result, it keeps it in a suspense account. Since the payment has not been applied to John Doe’s account, it will continue to show as “premium outstanding”. It will hopefully get updated to “paid up” after a few days / weeks but, if something were to happen to John Doe and family during the interim period, his claim will get denied. This is not fair to John Doe but, I reckon, 7 out of 10 times, this is exactly what happens. And the root cause of this problem is the memo field that’s too short. And the result is, experienced people might revert to cheques for paying their insurance premiums in future.

LONG MEMO FIELD. The memo / description field on electronic payment forms should be long enough to accommodate the narration that a Payer would need / like to use in order to clearly communicate the purpose of the payment to the Payee. Take, for example, an individual John Doe who previously made health insurance premium payments by cheque. The insurance company typically asks him to write something like “Health Insurance Premium for FY2012-13 for John Doe & Family” on the reverse of the cheque to help apply the payment to his account. It’s easy for John Doe to follow that instruction when he pays by cheque. Everybody is happy. But, when John Doe goes electronic and tries to enter this narration, his bank will stop him midway. When I tried this on my bank’s NEFT form, I couldn’t get past “Health Insurance Pre” in its transfer description field. Abbreviations recommended by supercillious bankers like this could prove disastrous to Payers. When a policyholder like John Doe truncates narrations, the insurance company receives a payment but doesn’t know from whom or for what. As a result, it keeps it in a suspense account. Since the payment has not been applied to John Doe’s account, it will continue to show as “premium outstanding”. It will hopefully get updated to “paid up” after a few days / weeks but, if something were to happen to John Doe and family during the interim period, his claim will get denied. This is not fair to John Doe but, I reckon, 7 out of 10 times, this is exactly what happens. And the root cause of this problem is the memo field that’s too short. And the result is, experienced people might revert to cheques for paying their insurance premiums in future.- COOLING PERIOD. Payers can cancel cheques via the “Stop Cheque” facility. In banking parlance, we say that cheques are revocable. On the other hand, most forms of A2A electronic payments are not revocable. In fact, it could be argued that irrevocability is one of the major USPs of ePayments. That’s definitely true from the Payee’s perspective. But it ignores the interest of the Payer who might have genuine reasons for wanting to cancel a payment after initiating it. I don’t expect ePayments to support the equivalent of “stop cheque” – that would be sacrilegious. That said, it shouldn’t be very hard for banks to introduce a “cooling period” within which payers can withdraw ePayments after submitting them. As a matter of fact, the recently enacted Dodd Frank 1073 rule mandates a cooling period of 30 minutes for all electronic cross-border payments originating inside the USA. (This is different from the 24 hour cooling period imposed by a few banks to initiate an ePayment, a practice that I’d called out in Height Of eBanking Irony).

- HIGHER TRANSFER LIMITS. Electronic payments have different transfer limits. For example, I use the Visa Card Pay feature on my online banking website to make my montly credit card payments. VCP has a limit of INR 49,999 per transaction. If my bill exceeds this amount, I use a cheque. If the limit on VCP were doubled from the present level, I’ll never use a cheque for this use case.

- MAKER-CHECKER. One person enters the payment details and another person reviews and approves it. This is the classical “Maker Checker” / “Four Eye” best practice adopted by many businesses for making a payment, raising a purchase order, and other critical transactions. Cheques support it. There are many MSME and SME firms that still use cheques presumably because their online banking / electronic payment website – which is the same as that provided to retail banking customers – does not support maker-checker.

Each bank will want to conduct a detailed study to evaluate the feasibility and priority of implementing the above measures in the context of its own business processes, IT landscape, payments types and volumes. But the above list should serve as a good starting point for everyone.

UPDATE DATED 20 JULY 2020:

It’s seven years since the above post was published. Thankfully, RBI has withdrawn almost all of its then proposed negative reinforcement measures against cheques. UK has announced “Confirmation of Payee” and “Enhanced Remittance Data” initiatives to solve problem #1 and 2 respectively. I don’t know of similar initiatives in any other trillion-dollar economy of the world. Cheques continue to reign supreme in USA, India, especially in corporate banking. But cheque usage in retail banking has come down considerably in many countries, thanks to frictionless mobile payments (worldwide), re/demonetization in India, and a combination of other positive and negative reinforcement measures.