Soon after I wrote Cheque Truncation System or Contract Termination System, a senior banker averred to me in private that India’s cheque truncation program had a lot of loose ends.

A friend of mine who used to work for a CTS solutions provider pointed out that the program had an ever greater impact on NBFCs than banks (For the uninitiated, a Non Banking Financial Company is a type of financial institution in India that can make loans and offer a few other financial products without holding a banking license).

To paraphrase this CTS professional’s comment, banks and NBFCs together handle around 2 million PDCs a month on the conservative side, which translates to an annual volume of 24 million. Since PDCs are customarily collected for three years in advance, there are 72 million cheques waiting to be sucked out of the system and replaced with CTS 2010 compliant cheques. Given that the cost of processing a PDC is around 2.5X of that of a normal cheque, “reprocessing loans with new CTS2010 compliant PDCs would mean a significant cost for banks / NBFCs”, my friend remarked.

Since the above post was published around six weeks ago, the Indian banking regulator has extended the CTS2010 cutover deadline by three months i.e. to 31 March 2013.

Since the above post was published around six weeks ago, the Indian banking regulator has extended the CTS2010 cutover deadline by three months i.e. to 31 March 2013.

While I’m no banker or NBFC specialist, I strongly doubt whether all the prerequisites for this migration would be completed even by the revised deadline, and predict a further delay of at least three months before the exercise is deemed complete and old cheques lose their validity.

—–

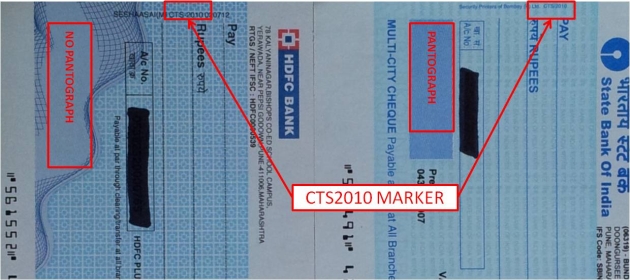

Getting down to mundane personal matters, I called my tenant and requested him to issue new CTS2010 PDCs to cover payments for his two year lease on my house. A couple of weeks later, he called me over to exchange the old non-CTS2010 cheques for the new ones. Even as I was receiving them, I noticed that the new cheques didn’t have a “pantograph” – yes, I had to look up what term meant – and lacked at least two more attributes that banks had said that CTS2010-compliant cheques should exhibit. When I wondered aloud whether the new cheques he was giving me were CTS2010-compliant, my tenant assured me that his bank had issued the new cheque book against his explicit request for CTS2010 compliant cheques. That confirmation, combined with the implicit trust my tenant and I enjoy with each other, persuaded me to treat this matter as closed.

But, going back to a generic context, what’d happen if someone with malafide intent deliberately tried to palm off old cheques as new, as Advait Rege asked in his comment to my Finextra post on this topic? If that happened, people receiving those PDCs would be left high-and-dry when their PDCs would bounce for being non-CTS2010 compliant.

The one way they could safeguard against the risk of being defrauded is by confirming that the PDCs they collect when entering into agreements are indeed CTS2010-compliant. This calls for a simple, yet foolproof, way of identifying / verifying CTS2010 cheques. Watermarks and pantographs are too obtuse for this purpose.

On closer examination of these cheques, it struck me there already is such a simple and foolproof marker.

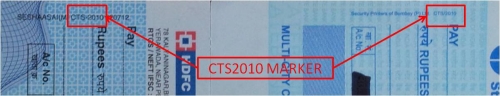

I’m referring to the text “CTS2010” printed inconspicuously on the left margin of new cheques.

I stumbled upon this text when I’d closely inspected the new cheques issued by my tenant. I subsequently studied several new and old cheques of a few more banks and found that the marker was present on all cheques otherwise known to adhere to the CTS2010 standard – even if they lacked the “pantograph” – and absent from all old cheques that were non-compliant. While I haven’t seen the cheques of scores of other banks, the result of my little experiment got me wondering if this marker alone could serve the purpose of establishing whether a cheque was CTS2010-compliant or not.

Regardless of the ubiquity or otherwise of the CTS2010 marker, I wish the banking industry and / or the regulator had created a logo for the nation’s cheque truncation program and printed it on all new cheques. By eschewing things like “pantograph” and avoiding “spot the six differences” style of communications, banks could remove much of the anxiety caused by the CTS2010 cutover.

In a broader context, this is yet another opportunity for banks and financial institutions to eliminate friction in their processes by improving communications, and thereby accelerate the adoption of their products and services in the mainstream market.